Whether it’s the dawn of a New Year or time for a financial makeover, embracing one of these money-saving challenges is the perfect step in the right direction.

Whether you opt for a 7-day challenge, a 52-week money challenge, aim to save $100, or set a lofty goal of $10,000, a myriad of challenges cater to your needs. Additionally, personalized money charts allow you to define your own savings targets.

Embarking on a money challenge serves as a powerful motivator for those grappling with saving. Establishing a goal and maintaining personal accountability through a dedicated money-saving chart keeps you on the right track. Especially in these challenging times, it’s good to have a little money tucked away in case of emergencies.

So what say you? Are you ready to get started stacking your dollars and watching your money grow? These saving challenge printables are ready for you to use. Let’s go!!!

Monthly Money Saving Challenge

This monthly savings challenge is the way to save and budget throughout all 12 months of the year.

Incorporating a 10-20% saving strategy from each paycheck into my monthly budget has allowed my family to prioritize saving before spending. Download the Monthly Saving Challenge and make consistent saving a habit.

Save $10,000 in 12 Months

Challenge yourself to save $10,000 in 12 months with this visually engaging savings plan. Track your progress by coloring in a star each week and watch yourself become a savings superstar!

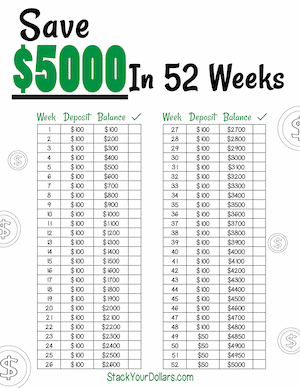

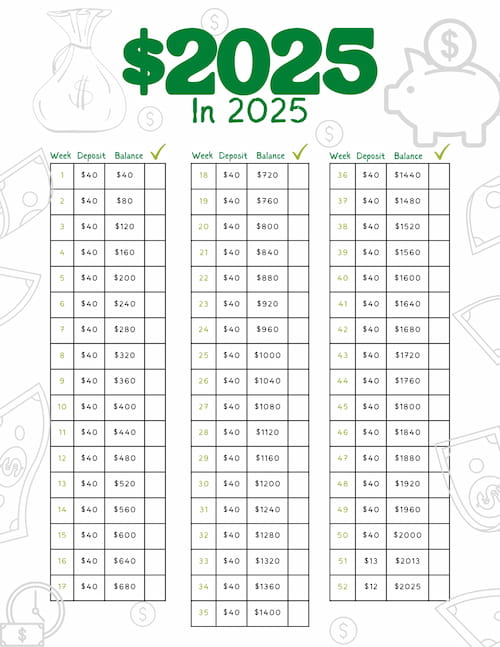

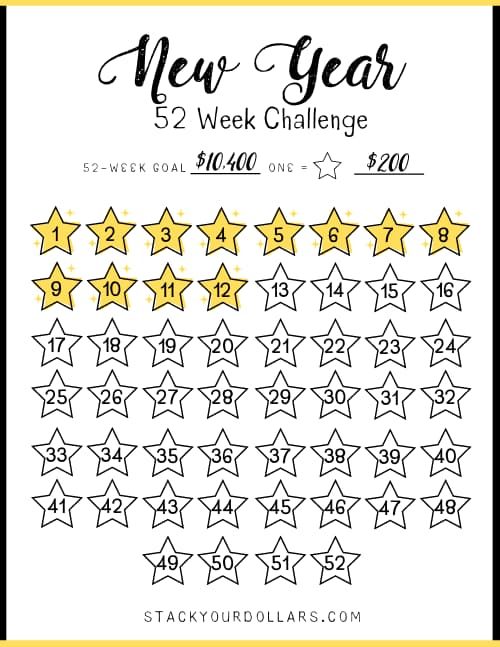

52-Week Savings Challenge

Explore a year-long journey of financial growth with the 52-week savings challenge.

Some 52-week money challenges start off at a low number, then slowly increase throughout the weeks. For me, I find it easier to save the same amount every week.

Check out the 2025 money savings chart along with other free budget printables and worksheets to create your budget binder.

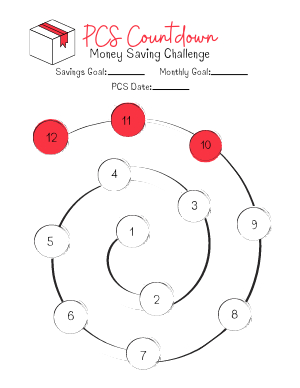

PCS Countdown Savings Challenge

Prepare for the unexpected with the PCS Countdown Savings Challenge. Especially relevant for military families, this challenge aids in setting aside funds for potential relocations, covering moving costs, hotels, and unforeseen expenses.

Associated costs can get expensive really fast and may take months to be refunded by the government. I find it prudent to save money money for this reason.

Related: Read about my PCS Overseas to Japan.

How much should I save? I recommend around $5,000 for CONCUS moves and $10,000 for OCONCUS; more if you have large or multiple pets that would need to be shipped.

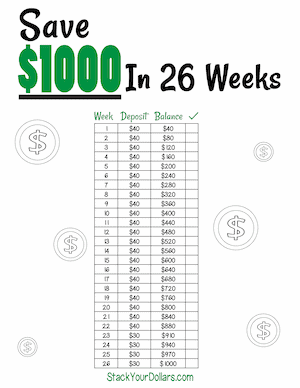

6-Month Savings Challenge

For those seeking a shorter commitment, the 6-month or 26-weeks savings challenge might be your ideal choice.

TIP: Break up the months by coloring in half of the numbers on this printable.

Download these, with other free budget templates here.

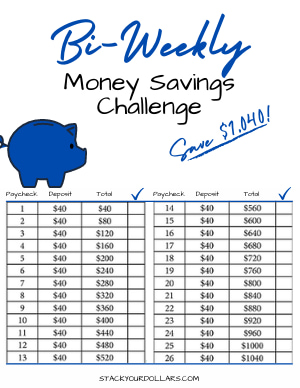

Bi-Weekly Savings Challenge

Optimize your savings with a bi-weekly plan, ensuring money is transferred immediately after each paycheck. Employ a 26-week money plan to align with your bi-weekly pay schedule. Out of sight, out of mind!

You can use a 26-week money plan to accomplish this goal as well! There are 52 weeks in a year, so if you receive a paycheck every two weeks, that’s 26 paychecks.

30-Day Savings Challenge

Meet short-term savings goals with the 30-day money-saving challenge. Experience the satisfaction of reaching your target sooner and gradually increase the challenge as you become accustomed to saving more.

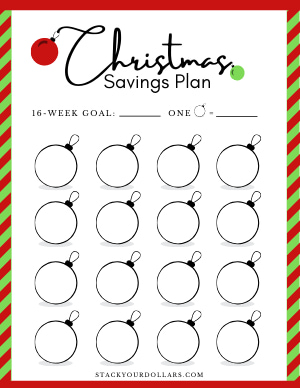

Christmas Money Challenge

Enhance your holiday season with the Christmas Savings Plan. Use this printable to plan and save for a joyful Christmas without financial stress. I’ve also included a few tips to make the most of enjoying Christmas on a budget!

100 Envelope Challenge

The 100 envelope challenge is an interesting new savings plan where you have to get 100 envelopes and label them each with $1-$100.

Each day, you pick one of the envelopes randomly and stuff it with the amount of cash it says. By the end of 100 days, you’ll have $5,050 saved!

However, that challenge seems a bit extreme to me. You could end up saving $5 one day and $87 the next!

If you like the idea of challenge, you can make it easier by picking a new envelope every week, and/ or doing a 50 envelope challenge instead. Doing one envelope every week would make the challenge last a little under 2 years.

New Year Saving Challenge

As we welcome a new year, it’s an opportunity to embrace a fresh start on our financial journey. Whether you’ve triumphed over your financial goals or encountered challenges, now is the time to turn the page and refocus our efforts on building a stronger financial future.

Get your New Year Savings Challenge here.

How to Save More Money

If you’re not already in the money-saving mindset, you’re probably wondering how you can find the money in your budget to do these challenges. It’s really simple!

All you have to do is:

- Skip eating out lunch a few times per week

- Learn how to change your car tail light yourself. I was almost charged over $50 for this 5-minute job!

- Turn your AC up a few degrees in the summer, or down a few in the winter.

- Or any of these other 40 cheap living tips to save more money every month!

Related: 10 Things To Stop Buying To Save Money

Conclusion

Embarking on a money-saving challenge is not just a financial commitment; it’s a journey toward financial empowerment. By integrating these challenges into your routine, you’re not only securing a brighter financial future but also cultivating a disciplined savings mindset.

Choose the challenge that resonates with your goals, download the printables, and let the adventure begin. Your financial success story awaits!

Starting fresh

Good luck on your journey!

-Martina