Are you eager to save money, clear some bills, or gain better control of your finances? Well, you’ve landed on the perfect page. For the unbeatable price of free.99, I’m here to guide you on living within a budget while still enjoying life!

Think it’s impossible? Think again.

While living on a budget, I’ve discovered that it’s possible to live my best life! By making modest sacrifices and staying within my financial means, I eventually experienced new adventures, traveled, and enjoyed a life free from financial worries.

Budget living isn’t just about pinching pennies; it’s about taking charge of your life and securing your financial future. Crafting a spending plan based on wise decisions empowers you to sidestep overspending, debt, and stress.

Ready to uncover the secrets of leading a fabulous life on a budget? Let’s dive in!

1. Create A Budget

If you’ve perused any of my previous posts, you might be a bit weary of the recurring advice, but bear with me—create a budget! The impact it can have on your financial well-being is significant.

Crafting a budget allows you to discern precisely where your money is going. Consequently, you can identify areas where it’s imperative to curb excessive spending.

Having your spending habits meticulously documented and summed up can be quite revealing. Splurging a dollar here and there may not appear consequential in the moment, but trust me, it has the potential to wreak havoc on your budget.

2. Pay Yourself First

An essential aspect of adulting involves prioritizing savings. Life is riddled with uncertainties, and the unexpected can hit at any moment. Imagine having to suddenly shell out $500 for car repairs—would your finances withstand such a hit?

Fear not! It’s entirely feasible to live on a budget and still contribute to your savings.

Once your budget is meticulously laid out, pinpoint areas where spending can be trimmed. The funds liberated from these cutbacks can now be directed toward your savings. Make it a practice to pay yourself first by allocating this money before engaging in any other expenditures.

Establish a savings goal and strive to save as much as possible. Once you reach this target, you can ease up a bit and introduce more flexibility. As an example, my husband and I initially aimed at building an emergency fund. After achieving that milestone, we redirected funds to create a travel fund, striking a balance between financial responsibility and enjoyment.

3. Separate Your Money Into Different Bank Accounts

Now that your spending plan is in place, preventing the inadvertent overspending is crucial. A strategy I find effective is separating my funds into different bank accounts.

Upon receiving each paycheck, our initial step is to allocate the money designated for savings and bills into a separate account. This account is set up for auto-payments of bills, with a deliberate decision not to use the associated bank card for daily expenditures.

Read More: All About My Bank Account: FAQ

Everyday expenses are then covered from the remaining balance in the primary account. This method ensures that there’s always a dedicated sum for bills, reducing the risk of insufficient funds. Moreover, by prioritizing savings and establishing a predetermined amount, we proactively set aside money before allocating funds for entertainment and leisure.

4. Get Your Household On The Same Page

Did I overlook mentioning the age-old wisdom? Teamwork is indeed the catalyst for success in adopting a more frugal lifestyle. Without everyone aligned on the same financial objectives, achieving success can be challenging.

As Abraham Lincoln wisely noted, “A house divided against itself cannot stand.” This principle holds true not only for nations but also for our household finances. Effective money-saving becomes an uphill battle if one person prioritizes saving while another leans toward spending. Mastering the art of budgeting as a couple minimizes conflicts, headaches, and stress.

It’s crucial that every member of the household, including children, comprehends the financial plan and the shared goals. Unity in understanding and working towards these objectives ensures a harmonious financial journey for the entire family.

5. Trim Your Monthly Expenditures

When navigating a tight budget, the most beneficial approach is to identify opportunities for cost reduction. Take a close look at your monthly expenses and discern areas where adjustments can be made.

Evaluate the necessity of certain expenditures—are Hulu, Netflix, and cable all indispensable? Is a prime membership currently essential?

Read More: Explore alternatives, such as getting rid of cable and embracing these cost-effective cord-cutting options.

Identify areas where you can cut back, whether it’s dining out, utility usage, or other discretionary spending. I’ve put together a comprehensive guide on living cheaper and reducing monthly expenses, offering valuable insights that could translate into substantial savings, potentially amounting to hundreds.

A personal example underscores the potential impact; my switch to the Berkey Water Filter System translated into a remarkable $1,680 in savings on drinking water alone. For those accustomed to purchasing bottled water, the potential for even greater savings is evident.

6. Embrace Frugal Living

Now, it’s time to bring your plan to life. Assume responsibility for your spending habits and adhere to the limits you’ve set.

Instilling frugality into your lifestyle revolves significantly around your money mindset, influencing your financial decision-making. A frugal mindset discourages impulsive spending and prompts a more discerning approach.

For instance, if your car dealership quotes $100 to replace your vehicle’s tail light, a frugal mindset would lead you to explore alternatives. You might discover a local auto repair shop willing to do it for $50 or opt to purchase the bulb for $10 and follow a tutorial to do it yourself.

This is the mindset of those who successfully save money—they seek the best deals, even if it means forgoing brand-name products.

7. Engage in Comparison Shopping

Much like the tail light bulb example, exercising caution in your purchases involves comparing prices at various locations. Whether you’re buying a new car, furniture, or simply grocery shopping, scouting for the best deals is key.

To secure optimal deals, I personally diversify my grocery shopping across three different stores, and I might even extend to a fourth if there’s a desirable item on sale.

An additional savvy tip is to compare the unit prices of the products you’re eyeing. Most stores display this information on the shelf label. Occasionally, an item may seem pricier than another, but a lower price per unit implies you’re getting more value for your money!

8. Don’t Try To Keep Up With The Joneses

Societal norms often suggest that spending money lavishly is synonymous with being “cool.” Our favorite celebrities inhabit grand homes, drive flashy cars, and flaunt extravagant clothing and jewelry, perpetuating the notion that this is the epitome of a desirable lifestyle.

However, attempting to Keep Up With the Joneses is a pathway to depleted pockets and mounting debt. Despite the illusion of affluence, pursuing this lifestyle might lead you down a road to financial ruin, presenting a stark contrast to the outward appearance of prosperity.

Interestingly, some of the very celebrities we admire also grapple with financial troubles. If your goal is financial freedom, it’s prudent to distance yourself from the Joneses’ narrative and prioritize a debt-free existence.

9. Opt for Monthly Grocery Shopping

Like me, if you find yourself consistently adding unplanned items to your cart during each grocery store visit, it might be time for a change. Multiple trips to the store in a month can be detrimental to your budget.

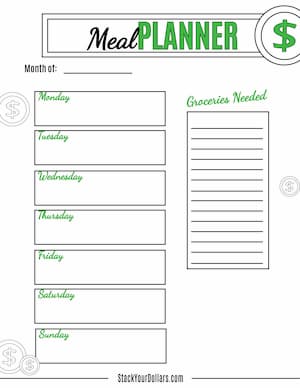

Previously, I used to shop weekly, sometimes even more frequently for forgotten items, causing a strain on my wallet. In an effort to adhere to our grocery budget, I adopted a method of creating a comprehensive monthly list encompassing every item we regularly purchase. Additionally, our meals are meticulously planned, outlining the required ingredients.

With a monthly grocery budget of approximately $300 for my two-person family, we follow this healthy grocery list for our main shopping.

Around mid-month, we take a second trip for fresh items that wouldn’t last the entire month. This reduction in store visits has significantly enhanced our grocery budget management.

10. Expedite Your Debt Repayment

Once you’ve established an emergency fund, redirect your focus towards eliminating debt. Exciting, right? Removing debt not only lightens your financial burden but also enhances the flexibility of your monthly budget.

To expedite debt elimination, surpass the minimum monthly payments. This strategy minimizes both the time required for payoff and the overall interest paid.

Opt for effective debt reduction methods such as the Debt Avalanche or Debt Snowball.

Read More: For additional insights, explore the “10 Best Ways To Pay Off Debt Fast.”

11. Stop Credit Card Usage

If you’re grappling with existing debt, compounding the issue by relying on a credit card is the last thing you should do.

Relying on a credit card to meet monthly expenses is a sign of overspending. To regain control of your financial situation, shift your mindset to purchasing only what you can afford. Opt for using your debit card or cash instead of a credit card.

Once you’ve successfully managed your finances, you can reintegrate the use of your credit card strategically. This approach can contribute positively to your credit score, provided you pay the full balance every month, eliminating any interest charges.

12. Discover Budget-Friendly Ways to Enjoy Yourself

Even when adhering to an extremely tight budget, there are plenty of affordable ways to have fun. A bit of creativity can open up a world of inexpensive entertainment and enjoyable family activities.

Consider these budget-friendly ideas:

- Picnic in the park

- Beach day

- Hiking

- Movie night with popcorn

- Board game competition

- Attend free local events

Leverage your local library, which I personally love, as a valuable resource. They offer a variety of free materials that you can check out, including books, movies, music albums, television shows, and more. What’s even better? You can download items directly from their online collection to your device—all at no cost.

13. Embrace DIY Projects

Consider whether there are tasks you’re currently paying for that you could handle yourself. Engaging in do-it-yourself (DIY) projects can lead to substantial savings.

For instance, I’ve shared in a previous post how I personally do my own acrylic nails for just $7. DIY pest control is another area where you can save hundreds by taking matters into your own hands rather than hiring an exterminator.

The realm of DIY projects offers a multitude of opportunities to save money while on a budget. Whether it’s crafting your own laundry detergent, making homemade yogurt, or tackling home updates, the possibilities are vast.

You can even explore DIY ideas to celebrate Valentine’s Day on a budget!

14. Adopt a Day-By-Day Approach

Developing financial comfort requires a crucial trait—patience. Recognize that acquiring everything you desire instantly may not be feasible. If a particular item isn’t within your budget, it’s essential to patiently allocate funds until it becomes affordable.

This also implies refraining from relying on credit for things beyond your immediate means.

For instance, when my husband and I moved into a new place, it took several months before our home was fully furnished. Why? Because we purchased items within our budget as we could afford them. While I could have dipped into our savings or used a credit card for quick gratification, both options carried the risk of creating debt, leaving us vulnerable in case of emergencies.

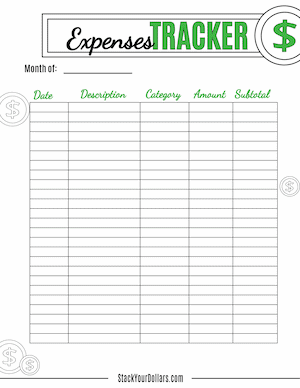

15. Monitor Your Expenditure

It’s crucial not to overlook tracking your spending!

If, for instance, you’ve already expended $40 out of the $50 allocated for entertainment halfway through the month, it’s time to exercise restraint. Vigilantly monitoring your spending prevents you from exceeding your budget before month-end.

Personally, I prefer tallying up receipts and reviewing my online bank statements to track spending. However, alternative methods include utilizing budgeting apps, adopting the cash envelope system, or creating an Excel spreadsheet. Choose the approach that best suits your preferences and financial management style.

16. Evaluate Your Monthly Progress

As the month concludes, take the time to assess your progress. Analyze what strategies have proven effective and identify areas that may need improvement.

If you find yourself exceeding your budget, delve into the reasons behind it. Can adjustments be made? Are there infrequent expenses that were overlooked during planning?

During one such review, I discovered that our family needed to reduce the frequency of shopping trips to align with our grocery budget. This process of introspection allowed us to take ownership of our spending habits and devise strategies to make our budget more accommodating.

17. Set the Challenge to Reduce Your Expenses

Mastering the art of living on a budget may seem challenging initially, but rest assured, with time, you’ll become a pro at it!

Take it a step further—ask yourself, can you spend even less each month? Perhaps you contemplate abandoning your car entirely and adopting a bicycle as your primary mode of transportation. For those working remotely, the idea of relocating from a costly city to a more affordable small town might prove appealing.

Challenge yourself to explore innovative ways to cut costs and continuously seek new opportunities for saving money. The journey towards financial adeptness is an ongoing and rewarding process.

Summary

Navigating a tight budget requires strategic planning and disciplined choices. Personally, my approach involves significantly reducing daily expenses, enabling a sustainable lifestyle on a single income.

By implementing the comprehensive tips outlined above, I not only managed to thrive within a budget but successfully maintained a comfortable living in California on just $2500 per month budget, all while actively saving money.

Fre

The 50/20/30 budget rule is a guideline for allocating your income. It suggests allocating 50% to needs (essential expenses), 20% to savings and debt repayment, and 30% to wants (non-essential expenses).

To live as cheaply as possible, focus on essentials, minimize discretionary spending, explore cost-cutting strategies like cooking at home, utilizing public transportation, and buying second-hand items. Prioritize needs over wants.

Surviving on $1,000 a month requires strict budgeting. Prioritize essential expenses, explore government assistance programs, cut non-essential spending, cook at home, and consider additional income sources such as freelancing or part-time work.

Living on a tight budget involves creating a comprehensive budget, distinguishing needs from wants, cutting discretionary spending, embracing frugality, exploring affordable entertainment options, and actively seeking ways to save money, such as DIY projects and comparison shopping. Regularly review and adjust your budget based on your financial goals.