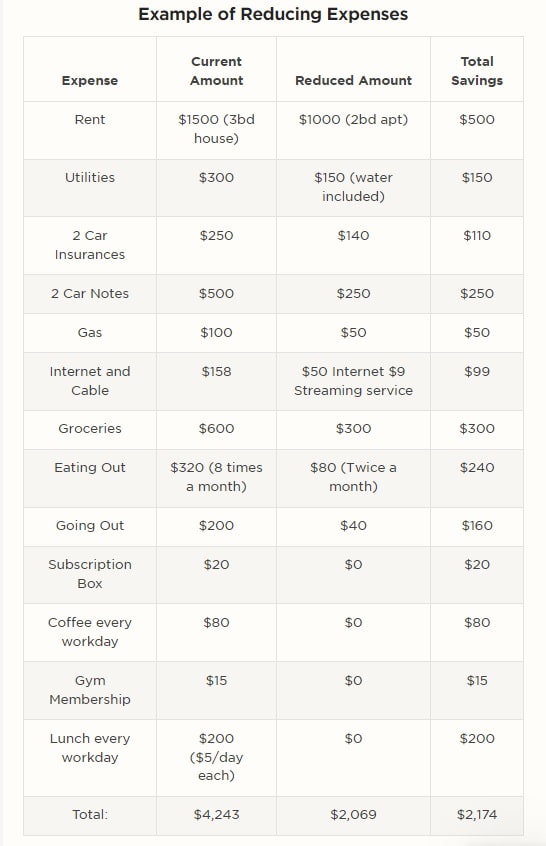

A family of four could reduce their monthly expenses by $2,174 and use that to pay off $26,088 of debt in a year! Here, I’ll show you the best ways to pay off debt fast and reach financial freedom.

Are you drowning in debt? Many people are and can’t seem to find a way out. Debt can hinder your dreams of living the way you want to; whether it’s being able to afford a home or go on vacation.

“The secret of getting ahead is getting started.” -Mark Twain

However, it’s not as impossible as it seems to get rid of your looming debt. With a little budgeting and smart money management, you can be on the way to your goals. To do so, these are the 10 methods to pay off debt:

- Create A Budget

- Reduce Your Monthly Payments

- Live On One Income

- Create An Emergency Fund

- Don’t Create More Debt

- Increase Your Income

- Sell Unused Items

- Pay More Than The Minimum

- Pick A Payment Method: Debt Snowball or Avalanche

- Don’t Give Up

1. Create A Budget

“If you don’t know where you’ve come from, you don’t know where you’re going.” -Maya Angelou

Without knowing where all your money is going to, it’ll be hard to make any lifestyle changes. Make a list of all your expenses, even the small ones, so you can determine where you need to cut back on spending. Then, create a budget to help manage your money.

2. Reduce Your Monthly Payments

“Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.” -James W. Frick

I’ve researched and gathered information from people online and across the web to compare what their monthly expenses are for a family of four.

In this chart, I show the average high amounts that they pay monthly. Then, I show how much can be saved based on what others budgeting in the same area pay. Those that pay these amounts could be reducing their spending by over two thousand dollars! Of course, these are only guidelines for reduced costs and everyone’s situation is different.

Related: 10 Things To Stop Buying To Save Money

You can reduce your monthly expenses by:

- Downsizing: Yes, it’ll be less space than you’re used to, but you could save hundreds! Plus, if you don’t have the space to hold any more things, you’ll be less tempted to buy more.

This is one money-saving tip that saved me over $12,000 in a year. In the post showing my actual budget, my small apartment was only $1,000 while many people I knew paid over $2,000 per month in San Diego.

- Monitoring utilities: Downsizing also means saving on utilities, less power is needed for a smaller place. Also, most apartments I’ve seen come with water included.

- There are several other ways to lower your bills like using fans instead of the AC, wearing layers instead of using heat, taking quick showers, etc.

- Comparison shop car insurance: Shopping around for the auto insurance rates can save you a lot of money, so can raising your out of pocket deductible. One person paid $250 to insure two new cars, while another paid only $140.

- Sharing a car: Selling one of your cars will almost cut your automobile expenses in half. That’s one less car note, car insurance, and one less car to put gas in. It could mean an extra $400 dollars or more every month!

- Cut the Cord: It’s time to cut the cord and jump on the cable-free bandwagon! You can cut off the pricey TV package and switch to one of the many online streaming services available.

- Groceries: Food is expensive and you can’t eliminate this expense completely; you need it to survive! However, you can greatly reduce your spending by couponing, buying what’s on sale, using generic brands, meal prepping, etc. Check out these meal ideas that will make at least 6 servings for under $10 and how my family of 2 spends $200/mo on groceries!

- Eating out: It’s convenient to go eat out when you’ve had a long day and don’t feel like cooking; however, going to restaurants adds up a lot. There’s the meal, the tip, and the overpriced drinks. Limit how much you go out to save money. For easy meals on busy days, cook foods that you can freeze and warm up quickly to eat.

- Going out: Just because you are trying to save money, doesn’t mean you have to sit in the house and stare at the wall all day. Instead of spending money going out, look for free events to enjoy in your location. Think about going to the beach, hiking, or a picnic in the park. Some places like museums also have free entrance on certain days.

- Subscription services: Trim out any unneeded subscriptions that you’re paying for. Do you really need that makeup box every month? Can you survive without the ad-free music? Don’t forget to cancel that gym membership you’re not using as well. Or, you could buy cheap, used equipment online.

- Lunch and coffee for work: With both spouses buying a $2 coffee before work, and about $5 of lunch each day, that adds up to about $280 a month. Cut out this expensive by preparing lunch at home, bringing leftovers, and making your own coffee.

Here are more ways to lower your monthly spending.

3. Live On One Income

“The quickest way to double your money is to fold it in half and put it in your back pocket.” -Will Rogers

One of the best ways to pay off debt is to live on one income. As a couple, if you spend one paycheck on your daily living, you’ll have another one to utilize for debt repayment.

This means that if you both make $50,000 a year… you’d live off 50k and use the other 50k towards paying off debt faster.

There are also great benefits to it such as being able to save much more and having financial security in case one partner gets laid off.

Look at these Tips For Living On One Income And Thriving.

4. Create An Emergency Fund

“By failing to prepare, you are preparing to fail.” -Benjamin Franklin

You may want to start aggressively paying off your debts, but don’t forget to save as well. If you have no money left over when an emergency arises, you could end up in more financial trouble. Try to have at least $1,000 saved, but a good goal to reach is saving 3 to 6 months of your expenses.

5. Don’t Create More Debt

“Too many people spend money they haven’t earned to buy things they don’t want to impress people they don’t like.” -Will Rogers

Don’t dig yourself a deeper hole… Stop using your credit card! The goal is to pay off debt, it’s counterintuitive to create more. So do what you need to do, hide your credit cards, or literally freeze them in the fridge. Also, don’t be tempted to finance things in the store, if you can’t buy it with cash, you can’t afford it.

6. Increase Your Income

“Opportunity does not knock, it presents itself when you beat down the door.” -Kyle Chandler

In addition to cutting back on your expenses, increasing your income will also help you pay off debt quickly. Apply the extra money you have coming into your household so you can reach your goals faster; this also includes any unexpected money or bonuses from work you receive.

For ideas on how to make extra money, look at “Side Hustle Ideas: Ways to Make Money On the Side.”

7. Sell Unused Items

“It is not the man who has too little, but the man who craves more, that is poor.” -Seneca

If you’re like me, you probably have a closet full (or more) of things you don’t use anymore. Have you thought of how much you could earn by selling all those items? Take the phone you had before upgrading, for example, you could sell it online for maybe $100. Even some things as small as a $5 flowerpot makes a difference. Sell enough, and you’ll have a nice chunk of change to apply to your debt!

8. Pay More Than The Minimum

“If we command our wealth, we shall be rich and free. If our wealth commands us, we are poor indeed.” -Edmund Burke

Paying extra money on your loans won’t only help you pay off the debt faster, but it also results in you paying less. The longer you take to pay off a debt, the more interest is added to it each month.

Let’s say you have a debt of about $5,000 at a 25% interest rate. If you take 2 years to pay this off, you’ll also be paying $1,404.58 in interest. If you quickly pay it off in 1 year, the interest would be half that amount, $702.65.

9. Pick A Payment Method

“Setting goals is the first step in turning the invisible into the visible.” -Tony Robbins

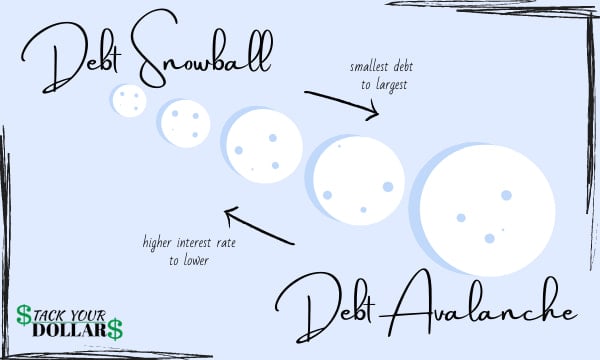

There are two popular debt repayment methods, the debt snowball and debt avalanche. The snowball method is very popular right now due to Dave Ramsey’s course; however, you would pay less interest with the avalanche method in the long run.

My examples will show 4 loans for a total debt of $25,000. I’ve set the loan terms all as 24 months, to make it easier, and adjusted the minimum payment to that timeline. Now, I’m not the best at math, so don’t quote me on these numbers, but I’ve checked calculators and they are pretty accurate.

Debt Snowball

With the debt snowball method, you order your debts from the smallest to the largest and pay off the smallest one first. Like a snowball, you keep rolling the smaller payment into the next, making larger payments.

| Loan Amount | Interest Rate | Min. Payment | Pay off time | |

|---|---|---|---|---|

| Personal Loan | $1,000 | 13.5% | $48 | 2 Mos. |

| Credit Card | $4,000 | 25% | $213 | 7 Mos. |

| Auto Loan | $5,000 | 7% | $223 | 11 Mos. |

| Student Loan | $15,000 | 6.08% | $665 | 16 Mos. |

In this example, one would start off paying an extra maybe… $500 on their loans every month. This is money you have earned from saving with the tips above, or making extra money on the side.

So instead of paying the $48 minimum on your personal loan, you start paying $548 monthly. After paying it off in about 2 months, you can then apply that $500, plus the $48, and the $213 to pay a total of $761 each month on the credit card. Bam! 7 months and it’s paid off!

Keep in mind that you should still be paying the minimum amount on all your other loans at the same time.

Next up, you’ll be paying $984 on the auto loan and pay it off in 11 months. By the end of 16 months, you’ll have paid off all your loans.

Debt Avalanche

With the debt avalanche method, you order the loan by interest rate with the highest to lowest one. You pay off the loan with the higher interest rate first, then move on to the next highest.

| Loan Amount | Interest Rate | Min. Payment | Pay Off Time | |

|---|---|---|---|---|

| Credit Card | $4,000 | 25% | $213 | 6 Mos. |

| Personal Loan | $1,000 | 13.5% | $48 | 7 Mos. |

| Auto Loan | $5,000 | 7% | $223 | 11 Mos. |

| Student Loan | $15,000 | 6.08% | $665 | 16 Mos. |

Like the debt snowball, I used an example of paying an extra $500 every month on the credit card, while still making minimum monthly payments on the other loans.

After paying about $713 every month on the credit card, it will be paid off in 6 months. After that amount of time, only about $774.56 will be left on your personal loan, and you can pay that off in a month with the extra money freed up.

At the end of using the debt avalanche method, you’ll also have paid off $25,000 in loans (plus the interest) in about 16 months.

Debt Snowball vs Avalanche

There are many arguments as to which of these methods are better. While the debt avalanche will result in lower interest paid, the debt snowball might keep you motivated with quicker results.

| Payment Type | Total Interest | Out of Debt in: |

|---|---|---|

| Minimum Amount | 2611.43 | 24 Months |

| Snowball | 1440.96 | 16 Months |

| Avalanche | 1391.19 | 16 Months |

With the examples shown, your first loan with the debt snowball is paid off in 2 months versus 6 months with the debt avalanche. However, with both methods, you will be able to pay off debt fast in about 16 months.

On the other hand, you will be paying about $50 less interest with the debt avalanche. However, the longer amount of time to see results may make some people fall off track and want to quit early.

Whatever method you decide on, use what would be best for you. At the end of the day, the results were still over $1,000 saved on accrued interest, and my fictional person got out of debt faster!

Also, note that the results could vary based on your particular loan amounts and interest rates. Though, I have tried out different amounts and the avalanche method resulted in less interest paid.

10. Don’t Give Up

“It does not matter how slowly you go as long as you do not stop.” -Confucius

The most important thing is to keep pushing and keep tackling your debt. It’s only with consistency that you will start to see a change and get out of debt.

Set goals and don’t be afraid to celebrate your milestones either; they’ll help keep you motivated.

If no one else, I’ll be here to cheer you on as you continue on your journey! Share your accomplishments in the comments below.

Frequently Asked Questions

You can pay off your debts from the smallest amount to the largest, or by starting with the higher interest rate loan. It depends on if you’d prefer to see progress quicker or pay more interest over time.

While it’s good to get rid of your debt, you shouldn’t forget to save money as well. Having no emergency savings when tough times come will only leave you in further need of debt relief. Before you start tackling your debt head-on, try to save about 3 to 6 months of your monthly expenses.

Pay off debt quickly by not creating more, saving or earning more money to apply to it, and rolling your payments from one loan to the other.

From what I know, these are the best ways to pay off debt fast. If you think others would benefit from this post, pin or share me! If you have any other tips, please let me know.