As a Navy family, my husband and I have saved thousands of dollars over the years by using a military budget worksheet similar to the one below. Well… technically, it was more basic and just a note created in the app of my cellphone. But isn’t paper and pen so much better?

Anyways… It wasn’t easy, and it took a while for us to get on the same track. I’m sure you’ve probably experienced or heard about the spending that goes on during deployments and port visits!

You might be going through that or other situations that make you think that it’s just impossible for you to be able to save money too. But… we eventually got there, and you can as well.

And it all starts with creating your military family budget!

This post may contain affiliate links as a way to support the costs of this website (at no additional cost to you); however, I won’t recommend products I don’t believe in. View my full disclosure at the bottom of the page.

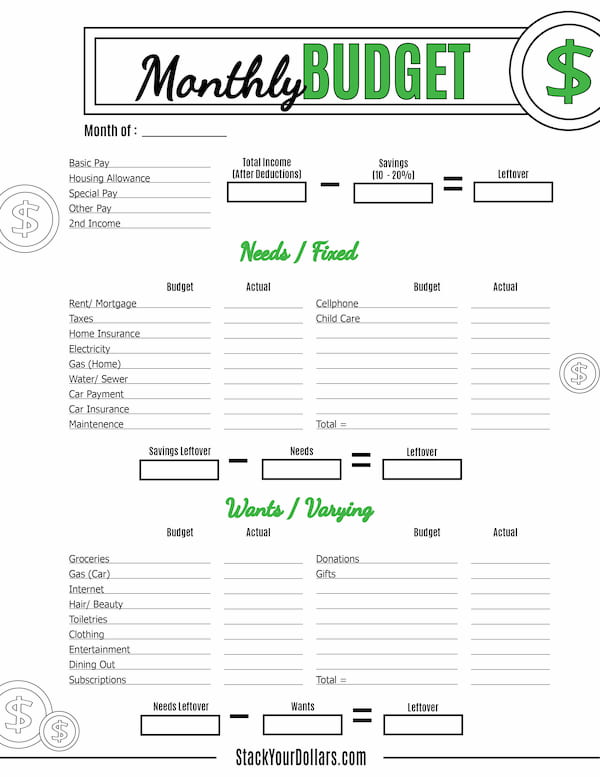

How to Fill Out the Worksheet

For my budget, all I did was put the amounts for Basic Pay, BAH, and BAS. Then, I put the total pay minus taxes for the actual take-home pay.

From this, we decided to take out 20% to save before spending anything else. (You can start with a lower percentage and work your way up.)

This chart shows approximately how much you could save every month. Since the housing allowance is different for everyone, it is only calculated based on basic pay.

| Pay Grade | Savings Goal (10% – 20%) |

|---|---|

| E-1 (1733.10) | $173 to $346 |

| E-2 (1942.50) | $194 to $388 |

| E-3 (2042.70) | $204 to $408 |

| E-4 (2262.60) | $226 to $452 |

| E-5 (2467.50) | $246 to $493 |

| E-6 (2693.70) | $269 to $538 |

| E-7 (3114.30) | $311 to $622 |

| E-8 (4480.20) | $448 to $896 |

| E-9 (5472.90) | $547 to $1094 |

When you calculate based on the other pays, you could save so much more!

Example:

Basic Pay (E4)- $2262.60

BAH (VA)- $1734.00

BAS- $372.71

Total= $4369.31

Savings (10%-20%) = $437 to $874 per month

Ready to make your budget? Here is the breakdown of all steps:

- Calculate your total after-tax income from all sources.

- Set a savings goal. Decide how much you would like to save every month and take out that amount first. I recommend at least 10%.

- List all of your needs. Once the total of this is calculated, what is leftover can be used for “wants”.

- List all of your wants.

- Adjust your spending. If there is not enough money to cover your expenses, find ways to lower it or increase your income.

- Stick to the plan. As you go through every month, track your progress to avoid overspending.

PRO TIP: Go through your bank statements to track all the money you’ve spent. When you identify an area of weakness, circle or highlight all of them then total up the spending. This is how I realized I was going to the grocery store way too much and buying unneeded things.

Needs

Needs are the things that you require to survive. When deciding, think… “Can I live without this?” For me, they included things like rent, utilities, insurance, a car, etc.

However, some wants can seem like they are needed. For instance, you might want a bigger house than is necessary. Or, while you do need clothes, you don’t need to buy new ones every month.

Wants

Wants are things that you desire but don’t require. This includes groceries, getting hair cuts, entertainment, subscription plans, etc.

Some things don’t fit easily into a category. While food is necessary for survival, the specifics of what is bought are easy to adjust. Ex: Food and water are needed, but expensive cuts of meat or gallons of juice are not.

Related: Take a look at my $200/mo, healthy grocery budget for two to get ideas on saving money!

Download your free military budget worksheet now!

Military Family Budgeting Tips

A major way that we were able to save money every month was by renting a small apartment instead of spending all of our BAH. We also only have one car, so that saves a bit of money as well!

Another great way to save is to live on one income even when you have two streams of money. When I’ve been fortunate enough to get a good job after PCSing, I save that extra money instead of finding more ways to spend it.

“It’s not your salary that makes you rich, it’s your spending habits.” —Charles A. Jaffe

We also already get our eye exam free through Tricare. But, did you know that you can order your glasses as low as $6 through websites online. Crazy, right?

There are tons of different ways to save money! Here’s a post with other ways to live cheaply and save more money!

You can also view more great budgeting tips for military families by MilSos. If you can think of anything we haven’t covered, be sure to share in the comments!