Payroll tax deferral? What’s that?

Well, in 2020 due to the ongoing COVID-19 pandemic, the people in charge at the White House thought it might be a good idea to defer federal tax collections from our paychecks.

Note that I said defer, but we’ll come back to that later.

Anyhow, this brilliant plan came about with the idea to put money in American’s pockets NOW when they need it and to provide incentives for employment.

2020 Payroll Tax Deferment

The Secretary of the Treasury is hereby directed to use his authority pursuant to 26 U.S.C. 7508A to defer the withholding, deposit, and payment of the tax imposed by 26 U.S.C. 3101(a), and so much of the tax imposed by 26 U.S.C. 3201 as is attributable to the rate in effect under 26 U.S.C. 3101(a), on wages or compensation, as applicable, paid during the period of September 1, 2020, through December 31, 2020, subject to the following conditions:

Memorandum on Whitehouse.gov

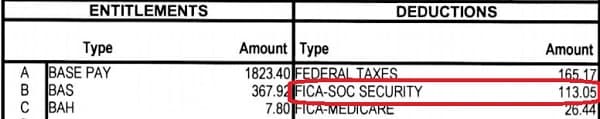

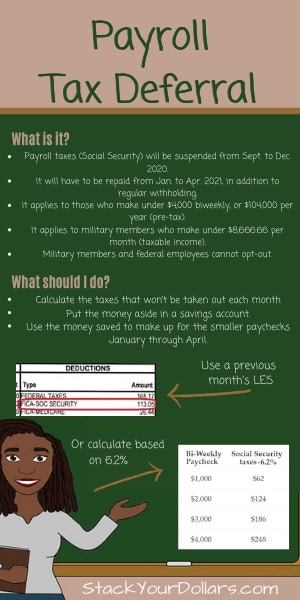

This applied to the Social Security tax or the railroad retirement tax equivalent. Social Security is taxed at 6.2%, so someone making $8,000 per month would get to keep $496. It seemed great, but if someone didn’t budget for it the next year, they could have ended up in a financial snafu.

The thing about this “tax holiday” is that to defer means to postpone, which means that people ended up paying back that money the next year. For September through December, there was no Social Security taxes taken out, then January through April, paychecks had double the amount (12.4%) deducted. (IRS Guidance)

In a U.S. Coast Guard bulletin and DFAS release, it stated that civilian employees making $4000 or under per pay period, and all military members making $8,666 per month and under would be affected. It also says that if you separate prior to full collection, the amount due will come out of your final pay.

Key takeaways:

- Collection of Social Security taxes were temporarily suspended.

- It affected those who make a pretax amount of under $4,000 bi-weekly.

- It applies to military members making below $8,666.66 per month; this can include ranks E-1 to O-6 based on taxable income. Tax-exempt allowances such as BAS and BAH are not included in the calculation.

- It affected paychecks from September 1, 2020, to December 31, 2020.

- This “extra” money had to be paid back by

April 30, 2021January 3, 2022; consider it a loan. - Military members and federal employees cannot opt-out of the tax deferral. Other employers have the option to enact this or not.

The Consolidated Appropriations Act, 2021 was passed and made effective on December 27th, 2020. Under this act, the period of repaying the taxes deferred will be extended to December 31st, 2021.

Read More: 2020-2021 Stimulus Checks

How to budget for this

The key to not being affected by the deferral was to pretend that the extra money isn’t there. Though if you do needed the extra money, it could be used.

Here’s the plan I followed:

- Calculate the taxes that won’t be taken out each month

- Put the money aside in a savings account (it will build a little interest as well).

- Use the money saved to make up for the smaller paychecks in January through

AprilDecember.

To know how much to save, calculate 6.2% of your paycheck.

| Bi-Weekly Paycheck | Social Security taxes |

|---|---|

| $1,000 | $62 |

| $2,000 | $124 |

| $3,000 | $186 |

| $4,000 | $248 |

Or, if you’re an active-duty military member, check your LES to see how much is usually deducted every month.

Since the Consolidated Appropriations Act, 2021 was passed and extended the deadline to December, I’ll assume that 1/3rd of the taxes will be taken back every month. Ex. Instead of $62 being taken from your paycheck Jan-April, $21 would be collected Jan-Dec.

You can check your LES on the next military pay date for the exact amount.

Frequently Asked Questions

A postponement of the collection of social security taxes and the railroad retirement tax from Sept. 1 to Dec. 31, 2020.

As of now, this deferral is not a forgiveness; the taxes will have to be paid back before December 31st, 2021. The presidential memorandum does says, “The Secretary of the Treasury shall explore avenues, including legislation, to eliminate the obligation to pay the taxes deferred pursuant to the implementation of this memorandum.” Nevertheless, only Congress can forgive taxes.

Employees who make less than $4,000 bi-weekly, or the equivalent in respect to their pay period, are eligible for the payroll tax deferral. However, the employer does not have to defer payroll tax and first has the choice to opt-in.

Changing your tax withholding will not negate the 12.4% tax on paychecks Jan. – December 2021. It will only result in a larger tax return or less money owed.