Life is like a bunch of chocolates. You never know what you’re going to get. Unfortunately, what you get from life isn’t always going to be as sweet as a piece of chocolate. In this article, these emergency fund examples will hopefully show you why it’s best to start creating one. Bonus: I’ll teach you how to start saving today as well!

Why might a person need an emergency fund?

An emergency fund is money that you stash away for all of those unexpected financial surprises in life. When you’re already going through a stressful situation, it can help you reduce the pressure of your dilemma by already having money set aside to cover those emergency expenses.

Situations in which you might need to use your emergency savings account include:

- Car Repairs

- Home Repairs

- Medical Emergencies

- Job Loss

- Unexpected Travel

- Moving Expenses

- Family Emergency

Emergency Fund vs Savings

I may be guilty of using the term “savings” for both, but an emergency fund and savings are different.

People create savings for a variety of things: a new car, college, buying a home, etc. However, these are all things that are planned. An emergency saving, on the other hand, is for situations that are completely unexpected (i.e. car or home repairs).

That is the fundamental difference between regular savings and an emergency fund, one is for a planned expense, and the other is not.

An emergency fund gives financial security by providing a safety net for times when the unexpected happens.

Rainy Day Fund vs Emergency Fund

For some, another name for rainy day fund is emergency fund; both terms are often used interchangeably.

However, a rainy day fund is also used to describe an emergency expense that is up to maybe $1000 (a small amount).

For example, a dishwasher in need of a $250 repair would constitute the use of a rainy day fund. But, losing a job would mean using your emergency fund to cover the months of daily living expenses until a new income source is acquired.

So, while some people do use the two terms the same way, a rainy day fund is typically for a small, one-time payment and an emergency fund is for larger payments that you may have to cover for several months.

Emergency Fund Examples

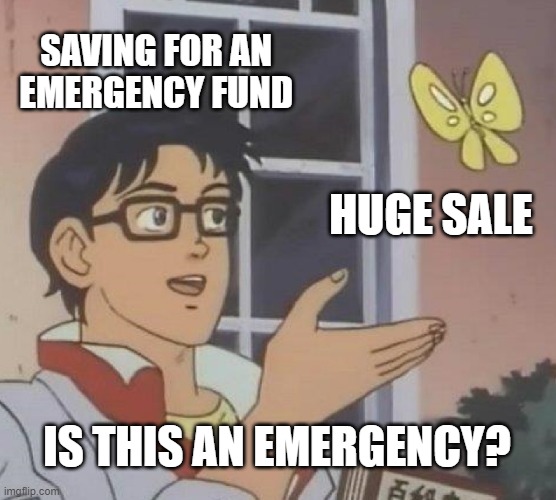

View more funny money memes.

1. Car Repairs

Car repairs are one of the most common emergency expenses that there are.

There were 33,654 fatal car crashes in the U.S. in 2018, that’s about 92 per day! And that is just the amount of crashes that resulted in a death, the actual amount of crashes that just ended in just a little fender bender is much much more. The probability that at some time your car will get damaged is high.

Besides that, there are other common issues like needing a replacement battery, getting a flat tire, or the AC going out in the middle of the hot summer.

Repairs like these can be just a couple hundred dollars or go into the thousands.

2. Home Repairs

Owning your own home is awesome. I mean, there’s the equity it builds, the freedom to do what you want, tax benefits, and more! However, what I consider the worst part of home ownership is having to repair any damages that happen!

Some of the most common home repairs include appliances breaking, roof leaks, or the AC or heat going out. If you live in a state with frequent hurricanes as I do, having to repair the water damage or a leaky roof is also something that could happen.

These repairs are usually urgent and can cost thousands of dollars.

Basically, you don’t want to end up in a situation where you’re saying, “My house is falling apart and I can’t afford to fix it!” Saving money will allow you to have the funds to cover any emergency home repairs.

3. Medical Emergencies

As we’ve learned from the recent epidemic, things can happen fast and unexpectedly. Many workers are being forced to confine themselves at home to stem the spread of the virus. If you’re able to telework or have sick leave, that’s great; however, many hourly, part-time, or contract workers have to take unpaid time off.

Losing a couple of weeks of income can be devastating for those that live paycheck to paycheck or don’t have an emergency savings account.

Other unexpected medical emergencies could happen at any time. I remember suddenly having horrible stomach pain and having to rush to the emergency room. A week later, I was undergoing surgery to remove my gallbladder. I got out of the hospital on Christmas eve.

These unexpected hospital bills, even with insurance, and being out of work is where having an emergency fund comes in handy.

4. Job Loss

Job loss is the main reason that my family has decided to always live on one income, even when we have two streams of it. With the frequent moves in military life, and depending on your career field, it can take months to find a new position that pays well.

If for any reason you suddenly have to quit your job, or you get unexpectedly laid off, your bills will still need to get paid. Your mortgage/rent, utilities, food costs, etc. are not going anywhere and you don’t want to end up in debt or homeless because of that!

It is generally recommended to have 3 to 6 months of emergency savings so that you are financially secure during these times; however, that can vary from family to family. Think about how long it took you to gain your last position and the availability of jobs in that field. This is how much emergency savings you should have.

5. Unexpected Travel

When a family member is sick or has passed away, the last thing you want to think about is the cost to go see them. Last-minute flight tickets can be very expensive. Having an emergency fund will keep you from having to put new charges on your credit card or not being able to go at all.

6. Moving Expenses

In the military, you usually PCS (move) every 3 to 6 months. This is an expense that you should be expecting and have already saved towards. However, some people get unexpectedly moved much sooner.

I have a friend who moved to one state, and then unexpectedly moved again just 2 months later. While the military does reimburse most of the moving costs, the upfront funds spent can still take a toll on your wallet. Not to mention, that’s an additional amount of time when one person will be out of work.

Similarly, any job could suddenly move locations or relocate you. An emergency fund will help you be able to cover the lost groceries, household supplies, furniture, movers, housing deposits, and any other associated costs.

7. Family Emergency

Life is full of unexpected surprises, and anything can happen in the family that requires emergency expenses or takes you away from work.

- Dealing with a loss

- Taking care of a child or other family member

- Emergency pet care

- Funeral costs

- Losses due to criminal activity

Having an emergency fund in any of these situations will give you the assurance you need to get through them with less stress.

Benefits Of An Emergency Fund

Unexpected financial emergencies can happen at any time, and with an emergency fund as your safety net, that is one less worry that you have to face.

The major benefit of having an emergency fund is simply not having to worry about money when you’re already facing other stressors. You’ll have the financial stability to cover expenses, maintain your lifestyle, and stay out of debt. Did I mention the peace of mind that comes with all of that? Yea… I might have once or twice.

According to the Federal Reserve’s 2022 report on the “Economic Well-Being of U.S. Households in 2021”:

- 32% of adults would have problems covering an unexpected $400 expense.

- 24% of adults had to skip necessary medical care due to the costs.

- 22% of those surveyed are just getting by or finding it hard to get by.

Having money in reserve for emergency situations will keep you from having to:

- Use a credit card

- Take out a high-interest loan

- Tap into your retirement fund

- Rely on friends or family members

- Scramble to sell belongings

You might be living comfortably now, but being unprepared for any emergency can turn things around quickly.

How To Start An Emergency Fund

You may think that you have no money to start your emergency fund, but that may not be true. It’s not hard, and it doesn’t have to be torture. But, emergency funds are very necessary. Take these simple steps to get started.

Tips for saving for an emergency fund:

1. Build a budget

It’s important to know exactly how much money you spend every month. Make a detailed list of your income and all of your expenses.

2. Follow these ways to lower your expenses

Once you know where your money is going, you can start to lower the amount you spend every month. From lowering your utilities to saving money on lunch, there are numerous ways to save money.

Just going without something for a short time can help you accumulate money in your emergency fund. When my family had cable, we would cancel it during the football off-season.

3. Make extra money

When there’s nothing else to cut out of your budget, there are other quick ways to build up your emergency savings account. You can start a side hustle, do a part-time job, sell unneeded items, etc.

If you’re in the military, here are additional ways to make more money.

Bonus: If you unexpectedly get any extra money, such as a work bonus, you should save it. And don’t forget about your tax refund, it’s a great way to quickly boost your emergency fund.

4. Put the money saved aside in your emergency fund

This step is very important! Once you’re saving that extra money, be sure to set it aside and do not touch it unless a true emergency happens.

An emergency fund should not be used for everything. It should not cover expenses such as:

- New furniture because there’s a great sale

- A new car

- Other planned purchases

- Expected, but one-time payments like car registrations, routine maintenance, or birthday/holiday gifts.

5. Congratulate yourself

Take the time to be proud of yourself. If an emergency occurs, you can weather through it with the confidence of having your finances in order. And when the time comes and you have to rebuild your emergency fund, it’ll be easier.

6-Month Saving Plan

To get started, let’s try this little 6-month savings challenge.

What can you cut back on every week? The daily coffee? The fast food runs? Buying snacks at the vending machine?

Let’s start by saving just $5 every week because every little bit counts. By the end of 6 months, you’ll have $120! As you get used to cutting back your expenses, you can start saving even more!

12-Month Emergency Fund Challenge

Are you up for the challenge? Let’s save $1,000 in a year. That’s about $83 every month.

Think about what you can reduce from your monthly bills to do this. Can you cut off the cable? Reduce unnecessary shopping? Stop eating out as much?

But don’t stop there! If you can save more than $1,000, you should!

Click here to get more money-saving challenges.

How much money should be in an emergency fund?

Saving a thousand dollars towards an emergency is a great start. However, your emergency fund is ideally supposed to cover a few months of your expenses.

The size of your emergency fund is generally recommended to be 3 to 6 months’ worth of your expenses and can be different for everyone based on their family size, lifestyle, and daily living costs. Personally, I would like to have a 6 to a 12-month emergency fund.

For example: If your monthly budget is $3,000, here is how much should be in your emergency fund:

- 3 months: $9,000

- 6 months: $18,000

- 9 months: $27,000

- 12 months: $36,000

What should be included in an emergency fund?

Your emergency fund should include all your major expenses in life and other daily living costs. Everything that would impede your lifestyle or cause you to go into debt should be covered in your savings. This includes:

- Housing

- Utilities

- Food costs

- Insurance

- Personal expenses

- Debt

However, it shouldn’t cover the other regular things in your budget such as entertainment or eating out.

Where to put your emergency fund?

The best place for your emergency fund is in an easily accessible account that does not have penalties when you need to withdraw it. You should always separate your emergency fund from your regular spending in order to prevent using it.

The best places to put your emergency funds are in a:

- High-yield savings account (Available at most banks including American Express bank, Synchrony Bank, etc.)

- Money market account

In both cases, you’ll be able to quickly and easily access your money when there is an emergency. Here are a few more places that it’s good to squirrel away money.

With luck, you won’t end up in any dire situation where you’ll need to use your emergency fund. Hopefully, the only surprise you’ll receive is what type of chocolate you pick up in the box.

But by preparing ahead of time, you can make lemonade when life gives you lemons. And you can get through any situation with the financial security you need to come out on top.

FAQ

$500 is a good place to start for an emergency fund, but ideally you should be able to cover a few months of unemployment.

This is quiet good a topic to help an individual and family.

You can send newsletter on the subject matter.

Thank you.