If anything, these last few years have taught us why it’s important to squirrel away money while you can.

Squirrels save food during the months when it’s plenty so that they can survive in the winter months of scarcity. Likewise, this phrase is an idiom about doing the same with money. Save money and “squirrel it away” for future times when you really need it.

Since 2020, unemployment rates were at an all-time high of 14.7% in April 2020 and are just starting to return to “normal”. The cost of living also typically rises an average of 2% over the years but has gone up to 9.1% in June of 2022.

All I’m saying is… $h!t is getting expensive ‘round here! Look at this data on how money has devalued:

Buying power of $10 in the U.S. compared to Jan. 2018

| Year | Buying Power |

|---|---|

| 2018 | $10.00 |

| 2019 | $10.16 |

| 2020 | $10.41 |

| 2021 | $10.55 |

| 2022 | $11.34 |

| 2023 | $12.07 |

Bruh! If you don’t save money and have an emergency fund, it’s time to start!

How to Be a Money Squirrel

According to the Royal Society Open Science journal, squirrels save and arrange their stored food using spatial chunking.

Now, I know that word sounds fancy, but spatial chunking is really just a way of saying that they organize their food into different caches such as having folders when organizing.

When they collect their nuts from a single place, they organize their caches into locations based on the species of the nuts. If they collect from multiple places, then it will be not only categorized by species of food but also by location and trying to stay away from the first area of storage.

This strategy helps them minimize the loss of food by rival pilfering squirrels. Similarly, we can save money by distributing it into different accounts to minimize the loss of buying power.

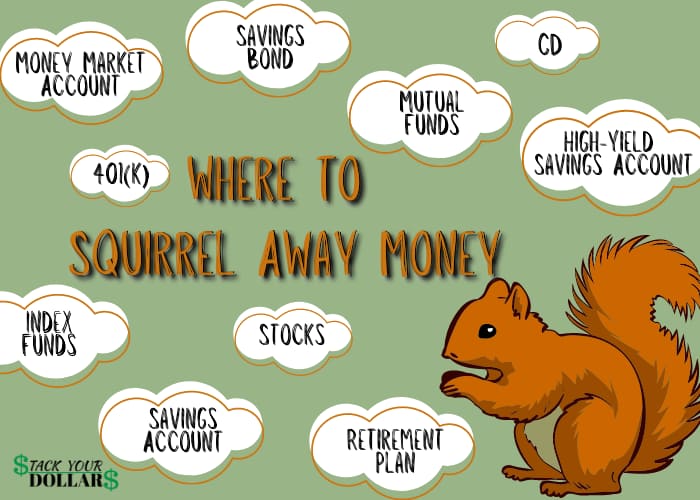

Squirrel Money Into These Accounts

Saving money is great, but you should also invest it into different accounts where it can grow. I already showed you how inflation decreased buying power, so maximizing your interest earning is a good way to lessen the effect.

You can store your money in different ways such as an emergency fund, regular savings, investment account, and retirement fund. Extra earnings can also be separated into a vacation fund, other types of retirement funds, stocks, etc.

1. Savings Account:

It’s easy and useful to have different savings accounts for different spending categories. You can access your money at any time with these accounts, but they have a really low-interest rate.

2. Money Market Account:

These accounts have higher interest rates than traditional savings accounts along with some features of a checking account. However, the minimum deposit and balance required are higher, and you can only withdraw money a few times per month. This could be a good choice to save your emergency fund.

3. High-Yield Savings Account:

A HYSA has higher interest rates and limited withdrawals like an MMA, but low to no minimum deposits. However, there is typically no debit card given or physical banks, and money can only be transferred within 24-48 hours from the account.

4. CD (Certificate of Deposit):

CDs have the highest interest rates and you are guaranteed that rate for the term of it. However, you cannot access your money during that time without a penalty. This could be best for saving money in cases where you know when you want to access it. For instance, saving a down payment for your home if you’re not planning to purchase yet.

5. Savings Bond:

These bonds are through the U.S. Treasury and typically offer a lower interest rate than a CD. They also have longer terms that your money is tied up for, such as the EE bond which guarantees your money to be doubled but must be kept for 30 years. However, they are “backed by the full faith and credit of the U.S. government” while CDs are only protected up to $250,000 by the FDIC. Savings bonds are only taxed at the federal level, rather than local and state like CDs are.

6. Retirement Account:

Retirement plans are a good way to save money and either defer taxes until you retire and are in a lower tax bracket, or pay taxes upfront if you think you’ll be in a higher one. Some plans, like a 401(k) also come with an employer match for your contributions. Retirement plans include 401(k)/ 403(b), Traditional IRA, Roth IRA, SEP IRA, TSP, Simple IRA, Simple 401(k), and Solo 401(k). However, the interest rates and risk of losing money vary depending on where you choose to put the money (such as stocks, bonds, funds, CDs, annuities, etc.). Most retirement accounts also don’t allow you to access the tax-deferred money until age 59 ½.

7. Funds:

Index and Mutual funds are a portfolio of stocks, bonds, and other assets shared by multiple investors. In a mutual fund, it is actively managed by a professional that tries to get more gains, but this also comes with more risks. This will also mean that index funds have lower management fees.

8. Stocks:

Stocks are the best way to possibly squirrel away your money and get the biggest return on it, but they also have the highest risk. It represents shared ownership in a company and the returns will be directly based on the company’s performance. In your overall portfolio, this investment type is best to save and invest money in if you have a higher risk tolerance. However, you can choose to only invest any extra money you have and it only takes a few days to access the money once you decide to sell the stock.

Top 3 Tips to Start Saving Money

- Live below your means

Save money by living on less money than you make and put away as much as you can. I aim for at least 20% of our income and more if it’s possible. You can do this by creating a budget and cutting expenses. - Save any extra money

My family lived on one income for a while, after we were both employed, we decided to continue living on one income and save the other. Similarly, if you get a raise, bonus, or inheritance, save that money and don’t increase your cost of living. - Pay off debt, and avoid more

Once you save for an emergency fund, prioritize paying off debt. Without the burden of debt, savings can be even greater.

Summary

Okay, that was A-LOT, right? But what this all boils down to is that it’s best to save your money in multiple locations as a squirrel does.

Squirrels do this to avoid losing food to other squirrels, but you can do it to avoid losing money and beat inflation.

You can choose what type of accounts to save your money in based on what you’re saving for. I recommend starting with the low-risk accounts, then moving on to investing in higher-risk types as you have more disposable funds.