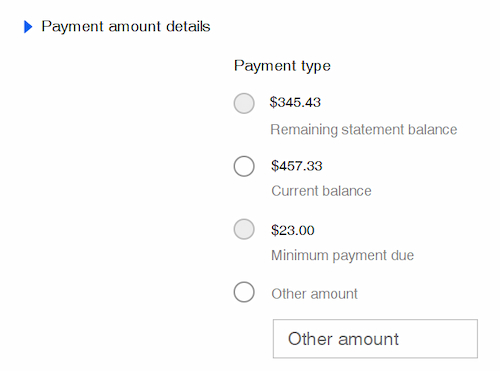

When I go to pay my credit card bill, there are 4 choices of amounts that I can pay. That is the minimum payment due, statement balance, current balance, or a chosen amount.

But what exactly do those amounts mean? And what happens if you can only afford to pay the minimum or even less? Making at least the minimum is good, but this is how you can avoid interest fees and make the best out of rewards points.

What is a minimum payment?

The smallest amount that you can pay towards your credit card each month is the minimum payment. If you pay any less than this amount, you will receive a late fee penalty.

This minimum payment is calculated based on a percentage of your total balance, your interest rate, and any other charges acquired.

Making only the minimum payment is okay to avoid any penalties and help improve your credit score by being responsible. However, you will end up paying more in interest over the many months and possibly years it will take to pay off a balance.

Financial institutions don’t make money by letting you borrow money with no conditions attached. The interest rates are how they collect extra fees on top of the balance you borrowed.

By paying over the minimum amount you’ll get rid of the debt faster and lessen the interest incurred.

I like to make everyday purchases on my credit card and then pay them off each month. This way, I still build up my credit but avoid any debt.

What is the statement balance?

If you’re like me, you prefer to get electronic statements rather than paper statements in the mail. It’s eco-friendly, plus I just don’t like sorting through and shredding all of the mail every month!

Your credit card statement includes all of the transactions made from your last billing cycle. A billing cycle is typically a month but can vary in length.

Your statement balance is the total of all those transactions made during the billing cycle. You will usually have 21-25 days from that account statement closing date to pay at least the minimum due or receive a late fee.

However, if you pay the full balance, you will not get your credit card interest rate charged.

Learn more in my credit card guide for beginners.

What is the current balance?

You might have wondered why your current balance is higher than your statement balance. I know that I did until I understood it.

The statement balance is your total from your last billing cycle; however, you are still adding to your total debt with new transactions and that is your current balance.

Your current balance can also be lower than your statement balance since it is continuously updated based on your recent payments as well as purchases.

What happens if I pay an “other amount” on my credit card?

Choosing to pay another amount than the minimum due, statement balance, or current balance may be fine depending on how much you’re paying.

- If you choose to pay less than the minimum due, you will still get a late fee in addition to interest charges. This will also affect your credit score negatively.

- Paying more than the minimum, but less than the statement balance, will make you not get any late fees, but you will get interest fees added.

- If you’re paying more than the statement balance, but less than the current balance, this is one of the best choices. You won’t get any late fees or interest fees, plus you’re making a dent in your total debt.

- If you choose to overpay and pay more than your current balance, your account will have a negative balance on your credit card. This means that the bank owes you that negative amount, rather than you owe them.

This has happened to me before when I paid my balance and then ended up receiving a refund on an item I returned. You can get a refund from the bank, or it will just go toward your new transactions.

How much should I pay on my credit card?

So… What is the best choice for how much you should pay on your credit card each month?

Making at least the minimum payment is good to avoid any late charges and keep your credit score improving. However, it’s better to pay over this amount.

The ideal amount you should pay every month is at least your full statement balance. This will prevent you from getting any interest fees that will add to your debt. This is the best way to cheat the system that’s designed to keep you in debt and also benefit from any reward points.

Personally, I don’t like owing “the man”, so I just pay the full current balance whenever I go to make payments.