Credit is the ability to get goods or services on the promise that the amount will be paid back at a later date. A credit card is a small plastic rectangle that allows you to make these purchases and are issued to you by a bank or business; but exactly how does a credit card work?

How Does A Credit Card Work?

Credit card issuers let you borrow a specific amount of money called a credit limit. Your limit is based on your income, credit score, and other factors that depict the overall trustworthiness of your repaying them.

As you make purchases, you are allowed to spend up to that credit limit. Using a credit card is like a loan that never ends, once you pay off the amount owed, your credit limit renews (this is called revolving credit).

For example: Let’s assume you have a credit limit of $1,000. You made some purchases and now owe $400, with a $600 available balance. If $100 is paid off, your available balance goes up to $700. If all $400 is paid off, you’re back to being able to spend up to your credit limit of $1000.

How Do Payments On A Credit Card Work?

Each month, you have to pay off a specific amount of the debt you have accrued. This minimum payment is calculated differently by the varying companies but is usually a set amount or 1-2% of your outstanding balance (whichever is greater) plus interest and fees.

You can avoid paying interest on your credit card by paying off the full balance by the statement due date. This grace period, according to the Credit CARD Act of 2009, is at least 21 days and your purchases do not accrue any interest.

While only paying the minimum payment is still great your for credit score, it’s bad for your wallet. The longer that you take to pay off your balance, the more you will end up paying due to interest fees.

For example: You have a $1000 balance with a 28% APR and have a minimum payment of $35. In the end, only paying the minimum would take you about 44 months to pay this off with an additional $532 in interest fees. Crazy, right?

To avoid interest, increase my credit score, and earn money as well, I do my regular monthly shopping on a cash-back credit card and repay the whole balance on the due date.

- Additional Fees Charged: These are various fees that can be charged by your credit card company in addition to the balance that you owe.

- Late payment fee: Late payment fees are charged when you don’t pay at least the minimum payment by the due date. You can avoid this fee by putting the minimum or the full statement balance on auto-pay.

- Returned payment fee: A returned payment fee is due if your method of payment was not valid (such as due to insufficient funds). This will usually be a $35 fee, so make sure the money is there before paying!

- Cash advance fee: Like a debit card, you can withdraw money at the ATM on a credit card. However, in addition to the possible ATM fees, you’ll also be charged about 5% on the amount you borrow. The interest starts adding up on the day you take it out and might be charged at a higher rate than usual.

- Finance charge: A finance charge is an interest you are charged on your credit card balance.

- Over-limit fee: Over-limit fees are charged if you make purchases that go over the amount of your credit limit. You will only get charged this fee if you are opt-in to the program, otherwise, your card will get declined when paying.

- Annual fee: Some credit cards charge you an annual fee to have it. This might be worth it to some based on the rewards they get and if it outweighs the cost.

- Balance transfer fee: Many credit card companies allow you to transfer your balance from one card to the other, but it comes with about a 3% to 5% fee. This can be great for getting your debt paid off at a lower interest rate.

- Foreign transaction fee: Purchases outside of the U.S. are charged a foreign transaction fee from 1% to 3%. You can avoid this fee by getting a travel card or another card with no fees.

How To Use A Credit Card

The best way to make use of our credit card is to:

1. Make On-Time Payments

Not only will you have a late charge if you pay late, but it also affects your credit score. Your payment history is a factor looked at when applying for other things that require credit.

2. Buy What You Can Afford

Only buying what you can afford to pay off each month will keep you from going into debt. I use my credit cards for my regular monthly grocery shopping.

3. Pay In Full

Paying your credit card balance in full will prevent you from having to pay any interest charges. If not, at least paying the minimum payment will help your credit score go up.

4. Stay Below Your Limit

Credit utilization is the percentage of your credit limit that you use. If your credit cards are maxed out, companies see you as more of a risk. It is good to keep your utilization below 30%.

5. Earn Rewards!

You can earn points, cash-back, airline miles, hotel stays, and more for using certain cards on purchases you’d be making anyway. However, not paying the balance off in full can cause the interest to outweigh any benefits.

Benefits And Drawbacks

With responsible use, credit cards can have a major benefit to you; using them in other ways can lead to a financial strain.

| Pros | Cons |

|---|---|

Credit Card Dictionary

The definition of some terms that will help you understand credit cards and how they work:

Credit Limit

Determined by the issuer, this is the maximum amount you can spend on your credit card. It takes into account factors such as your credit score, payment history, income, employment status, and other open credit accounts. With a good track record, it is possible to raise your limit over time.

Available Balance

This is the amount of funds that you have left available to you until your credit limit is reached. If you have a $5000 credit limit and made $2000 in purchases, there is $3000 still available.

Minimum Payment

The minimum payment is the amount you’ll have to pay each month to keep your account in good standing. It’s calculated from a small percentage of the overall balance, plus the finance charge and any additional fees.

Outstanding Balance

Outstanding balance is the unpaid amount on your loan that is still owed and accruing interest.

Statement Due Date

This is the date on your account or credit card statement that shows when you must make at least the minimum payment. Missing this payment due date will cause a late fee and possibly other charges.

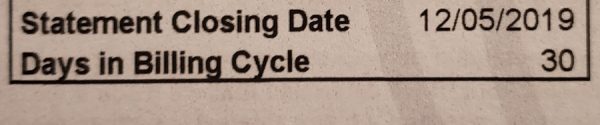

Billing Cycle

A billing cycle on a credit card is usually 25 to 31 days. Every purchase that you make within it is what will end up on your next bill.

Account Statement Closing Date

The last day of your billing cycle is the account statement closing date, this is when the credit card issuer will calculate your charges and send you a statement. However, there is a grace period of usually around 21-25 days until your statement’s due date. During this grace period, you can pay your bill without receiving an interest charge.

Note: This is also the date on which your balance will be reported to credit bureaus. So if your credit utilization is getting too high, you’d have to pay it off your balance before this day.

My statement closing date is Dec 5th and I have to make at least the minimum payment by the payment due date, Jan 2nd. That shows I have a 28-day grace period, and my next billing cycle would end 30 days from Dec 5th, which is Jan 30th.

Credit Score

A credit score is like the GPA of the adult world; while your GPA shows your academic achievement, your credit score shows your financial achievement. This 3-digit number tells your trustworthiness and reliability in paying back any loans which you may take out. According to Experian, very good to excellent scores are 740 to 850. A good score is 670-739. A fair score is 580-669. And a very poor score that usually won’t be approved for any line of credit is 300-579.

APR

APR, or annual percentage rate, is the yearly interest that is earned on the balance of your credit card or other loans.

Credit Utilization

Your credit utilization is the amount of money you have used compared to how much you have available. If you have two cards with a $1000 limit and used $500 on both, your utilization is 50%.

If you used the entire $1000 on one and none on the other, your credit utilization is still 50%.

FAQ

Raising your credit limit can be both good and bad for your credit. The credit card issuer will usually check your credit score first, so this request might temporarily drop your credit score. However, having a larger credit limit will lower your credit utilization rate, as long as you don’t increase your spending as well.

At least one payment per month is ideal, but you can pay off money on your credit card multiple times per month. However, you must make a minimum payment every month, even if you made multiple payments in the previous one.

You can make payments to pay off your credit card with cash, check, ACH transfer, online bill pay, or a money transfer. If you are having trouble paying off your debt, consider this article for ways to pay off debt quickly. It details ways to lower your expenses, make more money, and strategies to pay your debt faster.

No, you don’t have to use your credit card every month. However, it is beneficial to use it once every few months so that your account does not get closed due to inactivity. Closing a credit card can negatively affect your credit score if it affects the length of your credit history and your utilization.

Credit cards come with money up to a certain limit; however, you must pay the money back.

Found this information useful? Click to share or leave any questions below.

Excellent tips on using a credit card. Several years ago I used “secured credit card” issued by Capital One bank to rebuild my credit along with small loan from a community bank that reported my payments to all 3 credit bureaus.

Thank you! And that is a smart way to improve your credit. I speak about that, among other ways in my other post.

thx for sharing