While in school, your GPA (Grade Point average) was the most important number that you were judged by. Now as an adult, the 3 digits that matter the most are your credit score. Learning how to improve your credit score can be very beneficial to your financial future.

But why is a good credit score important? From taking out loans to even qualifying for an apartment rental or certain employment opportunities, your credit score is used to show the financial risk you pose.

Having a good credit score is important because it represents your trustworthiness and reliability when it comes to financial matters. Having a bad score will cause companies to view you as someone who’ll be unable to pay your bills on time, or potentially not at all.

This post may contain affiliate links as a way to support the costs of this website (at no additional cost to you); however, I won’t recommend products I don’t believe in. View my full disclosure at the bottom of the page.

Understanding Credit Scores

You don’t have just one credit score but multiple types. First of all, you’ll usually have a different score at all of the three different consumer credit reporting companies: Experian®, Equifax®, and TransUnion®. Then there is also your FICO® score and Vantage® score (the former being used more), along with the varying scoring models used by the different lenders and financial institutions.

In short, you can have hundreds of different credit scores based on the algorithm and different factors used to calculate it.

As shown in the picture above, I have three different scores with a 14-point difference.

Despite the varying credit scores you may have, the ranges and ways they are calculated are very similar. Thus, you can use the score as a good approximation of what lenders and companies will see.

Credit Score Ranges

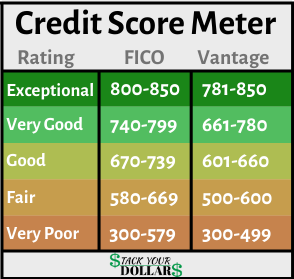

Most credit score models range from 300 to 850 points, with 850 being the best credit score possible. These are the most commonly used models:

- FICO: 300 to 850

- VantageScore: 300 to 850

- Equifax (Equifax Credit Score model): 280 to 850

- TransUnion (VantageScore® 3.0 model): 300 to 850

- Experian (FICO® Score 8 model): 300 to 850

According to Experian, these are the credit scoring ratings:

| FICO Score | VantageScore |

|---|---|

| Exceptional: 800-850 Very Good: 740-799 Good: 670-739 Fair: 580-669 Very Poor: 300-579 | Exceptional: 781-850 Very Good: 661-780 Good: 601-660 Fair: 500-600 Very Poor: 300-499 |

Most Americans have a “Good” FICO score and a “Fair” Vantage score.

Credit Score Calculation

Though the information is used differently by the various scoring models, the factors that affect your credit scores come from your credit report at the three credit bureaus.

What Affects Your Credit Score?

- Payment history: The record of whether or not you make on-time payments on your accounts.

- Amounts owed (Credit utilization): The amount of overall debt you carry and your credit card balances compared to the available credit. It is best practice to only utilize a max of 30% of your available credit.

- Length of credit history: Having a longer credit history is better for your score and shows experience. The calculation of your score will look at your oldest and newest credit account age and the average age of all accounts.

- Credit mix (Type of credit): Having a mix of various types of accounts shows that you are experienced with different credit types (ex. Revolving accounts (credit cards), installment accounts (mortgage, auto loan), etc. However, it’s not a large percentage of your credit score, so it isn’t necessary to gain more debt for this.

- New credit (Recent credit): Opening several new credit lines or getting many hard inquiries in a short period of time can negatively affect your credit score. (Hard inquiries are used to approve credit lines and will deduct points, but soft inquiries (checking your score, background checks, preapprovals, etc.) do not affect your score.)

- Balances: The total amount of debt carried throughout all accounts.

- Available credit: Some lenders like to see that you don’t have an excess of credit than you actually need.

Credit Score Calculation Algorithm

Despite updated versions, the scoring models commonly used by lenders are FICO score 8 and VantageScore 3.0. A good history of on-time payments, your credit utilization ratio, and the length of your credit history are the top 3 factors that influence credit scores.

FICO Score 8

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

VantageScore 3.0

- Payment history (40%)

- Age and type of credit (21%)

- Credit utilization (20%)

- Balances (11%)

- Recent credit (5%)

- Available credit (3%)

How to Check Your Credit Report & Score

There are several ways to get your free credit report and scores.

By law, you can obtain a copy of your credit report every 12 months. You can receive your credit report free yearly from:

- TransUnion.com

- Experian.com

- Equifax.com

- AnnualCreditReport.com (Created by the credit bureaus to check all three.)

Check your credit score for free using:

- Experian.com: (FICO® Score 8)

- Equifax.com: (VantageScore® 3.0)

- CreditKarma.com: (VantageScore® 3.0 using TransUnion and Equifax credit report data)

- NerdWallet.com: (VantageScore® 3.0 using TransUnion credit report data)

- Discover.com: (FICO® Score 8 using Experian data) Having an account is not required

- It may also be possible for free through your credit card or financial institution

Click for more ways to check your FICO and Vantage scores (not all options are free).

Credit Karma

I, along with my other family members, prefer to use Credit Karma.

They offer free credit monitoring that allows you to detect identity theft right away.

The last time I opened a new credit card, I was also notified of it through email. As a previous victim of identity theft, I think this is great!

This company is a nice way to keep track of your credit as it progresses; however, many people have seen that Credit Karma is not always accurate and may be 50 points more or less than your actual score used when applying for loans.

myFico

Another option is to check your credit score using myFICO; plans vary from about $20/mo. to $40/mo., but the scores are more accurate if you are looking to purchase a home or car.

The subscriptions all include a “FICO® Score 8, and may include additional FICO® Score versions. “.

If you need to check for a more accurate score, first find out what scoring model your lender will be using. Then I suggest purchasing a month from myFICO and canceling the plan before it renews.

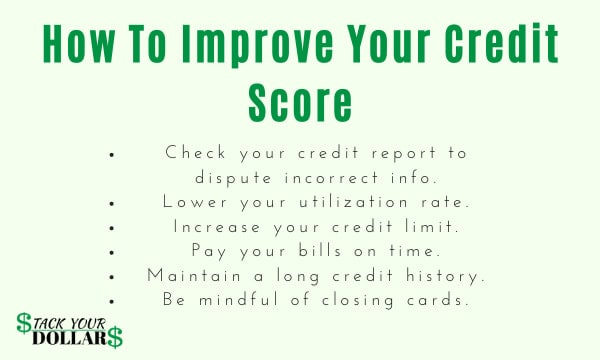

12 Ways To Improve Your Credit Score

To improve your credit score, start by checking your credit score and report to see your current standings. Seeing the information it contains and understanding the factors that affect it, will help you know where you can improve.

Raise Credit Score Instantly

If you have a low score, taking steps to rebuild your credit score can earn you points fast. Though it may not be in the blink of an eye, this is how to increase a credit score quickly.

- Dispute Your Credit Report: Disputing any inaccuracies and false information in your credit report is a fast way to boost your credit score. Be sure to check the report from all three bureaus, because companies may not report to every one of them. For example, I had someone’s $10,000 hospital bill on one of the credit reports until I disputed it.

- Pay Off Debt: As you should know by now, your credit utilization rate is important. If it is above 30%, pay it down to under that to boost a credit score overnight (almost).

- Increase Your Credit Limit: You can increase your credit limit by asking your current credit card issuer or opening a new credit line. By doing this, you lower your credit utilization rate. For example, if you have a maxed-out $500 card (100% utilized) and open another $500 credit line, your total utilization would drop to 50% as long as you don’t make any more purchases. (However, be mindful that too many inquiries also hurts your credit score. )

Things That Affect A Credit Score Positively

These actions are not quick, but they will improve your credit score over time. They’re easy ways to improve credit, and also how I increased my credit score to 800!

- Make On-Time Payments: Delinquent payments can stay on your credit report for up to 7 years. As one of the most important factors in the calculation of your credit score, be sure to not miss any payments on your bills. If needed, set your bills on auto-pay (you might also get a discount!). As seen in my simple budget, I created a second bank account for my bills to be paid from. After every payday, the money needed for the bills was automatically transferred there.

- Credit Utilization Ratio: As you use your credit cards each month, maintain a balance under 30% across all your accounts. If you don’t like to use a credit card, just buying gas or putting some small bill on it will be good for your score.

- Maintain A Long History: The age of credit lines shows your experience, so it’s better to have a long history. Paying off an old loan can also lower your score, but I would not let that stop me from getting out of debt!

- Be Mindful Closing Cards: Other than affecting your credit history, closing credit cards will also raise your utilization rate. Whether it’s an old or new card, be sure that your utilization rate will still be under 30%

- Make Multiple Payments: If you’re able to, making more payments on your debts will help you pay them down faster and increase your score.

How To Build Credit

- Get A Credit Card: Until you build up a history, you might only qualify for a secured credit card. This means you would have to make a deposit into a checking account, and that amount deposited would be your credit limit. As you continue making on-time payments, you’ll eventually qualify for better opportunities.

- Credit-Builder or Secured Loan: These credit-building loans help you build your score without putting money up front. Contrary to a regular loan, you don’t receive the agreed-upon money borrowed until you pay off the loan. Loans like this are usually given by federal unions and community banks, allowing those with low or poor credit to qualify easier.

- Get A Co-Signer: Though it’s not recommended to be a co-signer if you have someone willing to be one for you, it might be easier for you to get an unsecured credit card or loan. Be aware that any late payments or misuse will also negatively affect your cosigner’s credit.

- Become An Authorized User: If you have a family member or friend willing to, adding you as an authorized user to their credit line will let you share in their credit history. While this comes with a risk of that user being able to accrue debt, you don’t actually have to be in possession of a card; I’ve had family members who have done this.

What Hurts Your Credit Score The Most?

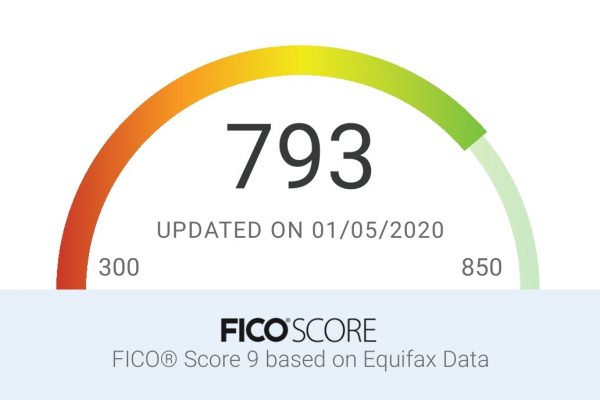

I used to have a credit score of over 800 points. At a time when I was going to buy a house, I received two inquiries on my credit; this resulted in over 30 points being lost. However, my score is now 793, and the inquiries will completely drop off after a total of 24 months from the date. Since there are no major purchases I will need to make until that time, I am fine with patiently waiting.

This is an example of why you need to know what affects a credit score negatively as well. Here are the things that you should avoid doing:

- Late Payments: As 35% to 40% of your score, making late payments will greatly affect your credit. If you are not usually late on a bill, you might be able to ask your financial institution to forgive the delinquency and not report it to the credit reporting companies. Late payments remain for 7 years.

- Closing An Old Credit Line: Even if you’re not using your old credit card, it’s best to keep it open. Closing the card will lower your credit age, and thus, your score. You might be able to just make a purchase on it every few months and pay the statement off to keep your account open.

- Maxing Out Cards: Carrying a high balance can show lenders that you have money management issues. Keep a low balance and your utilization rate under 30%.

- Multiple Hard Inquiries: With too many recent inquiries for new lines of credit, you can be seen as a risk to lenders. Each inquiry can “ding” your score 5 points. Hard Inquiries stay for 24 months.

- Bankruptcy: While filing bankruptcy can help you get rid of debt, it can drop your score by 150-200 points. Depending on the type of bankruptcy, it can affect your credit score for 7 or 10 years.

- Foreclosure and Repossession: A foreclosure (home) or repossession (auto) happens when the lender takes ownership of the property after missed payments. These stay on your credit report for 7 years.

- Errors On Your Credit Report: Don’t get penalized with a lower score when you’re not at fault! Be sure to always review your credit report and dispute any errors that are on it. Monitoring your credit will also let you know if there are any recent inquiries to your credit; this can help you prevent identity theft before it happens. I personally use Credit Karma, but there are other free ways to do this as well.

Bottom Line

A good credit score will allow you to have better financial opportunities. It can mean the difference between a 2% and a 20% auto loan, which would equate to significant savings in interest fees. In order to improve your credit score, always practice the habits that affect credit scores positively!

These are some posts that can help you on the way to the 800 score club:

- How Does A Credit Card Work? A Simple Guide (Learn how to use a credit card and improve your score!)

- 10 Best Ways To Pay Off Debt Fast (Ways to gain more money and apply it to getting out of debt.)

- Why It’s Hard to Save Money and What to Change (Learn the poor habits that can keep you in debt.)

Found this information useful? Feel free to share and help a friend as well!

These are great tips! Most people don’t realize how valuable their credit score is.

Yes, it really is. I’ve seen people with auto loan interest rates in the 20s while mine is under 3%. Such a difference!

So many people don’t realize that checking your credit often is key. Mistakes happen and so often a low credit score can be fixed by disputing them. Thanks for the great explanation and so many ideas to fix a score that is less than perfect.

Very informative post.

Anne

Wow, I love your website.

You have some great info on here.

Your article is super helpful. Thank you so much. People always need new info when it comes to getting credit and checking it 🙂

Thank you for this great article.

Thank you for your kind words! 🙂 I try my best to put out information I think can really help others.

Lovely post and very informative! How do we contact you for questions?

Hi Ashley! You may ask any questions you have here in the comments, or by contacting mail(at)stackyourdollars.com

why is it that on my home computer I can check my credit but not my husbands?

I’m not sure why that would be happening without seeing what you’re seeing. However, you could try it in an incognito window.

Martina,

This post was wonderful. Not only was it informative but the presentation and the links most helpful.

Thank You

Thanks, Amy! I’m glad I could help! 🙂