Money is something generally accepted as a medium of exchange for goods and services.

In simple terms, money is what you use to buy goods and services.

There are various types of currencies in the world. Two of the most widely used are the Euro and the United States Dollar.

Plural: Moneys or monies are both accepted plural forms of money.

Synonyms: There is a lot of slang for money such as cash, funds, legal tender, loot, dough, bread, dinero, greenbacks, moolah, bucks, guala guala, and currency.

Introduction to Money

The history of money dates back thousands of years ago; however, the bartering system was used before that. People traded what they had with another person who had what they needed.

This could prove problematic if one did not have something to trade that the other wanted.

Eventually, a monetary system was developed.

On the birth of money, Aristotle says, “When the inhabitants of one country became more dependent on those of another, and they imported what they needed, and exported what they had too much of, money necessarily came into use. For the various necessaries of life are not easily carried about, and hence men agreed to employ in their dealings with each other something which was intrinsically useful and easily applicable to the purposes of life, for example, iron, silver, and the like. Of this, the value was at first measured simply by size and weight, but in process of time they put a stamp upon it, to save the trouble of weighing and to mark the value.”

The first known use of coins is from the 7th century B.C. in the kingdom of Lydia in Asia Minor. Hundreds of years later, paper money started to circulate as well.

Money in Economics

Money has been defined in different ways. Some of the definitions of money by different economists:

Sir Ralph George Hawtrey (British Economist) – “Money is one of those concepts which like a teaspoon or an umbrella, but unlike an earthquake or buttercup are definable primarily by the use or purpose which they serve.”

F.A. Walker (American Economist) – “Money is what money does.”

The definition of money by Alfred Marshall – “Money includes all those things which are (at any time and place) generally current without doubt or special enquiry as a means of purchasing commodities and services and defraying expenses.”

John Maynard Keynes – “Money itself is that by delivery of which debt contracts and price contracts are discharged and in the shape of which a store of general purchasing power is held.”

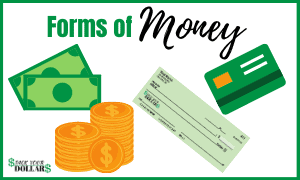

Forms of Money

Money can now be seen in a variety of forms than in the past. Some forms include coins, paper money, bank checks, and credit and debit cards.

How much money is in the US?

According to the Board of Governors of the Federal Reserve System, there is 2.32 trillion worth of Federal Reserve notes in circulation in the U.S as of March 2023. This is about 410 billion dollars more than there were in June 2020.

Where is money printed in the United States?

The U.S. Federal Reserve controls how much money is made each year, but the Bureau of Engraving and Printing (BEP) is the government agency that prints them. They have production facilities in Fort Worth, Texas, and Washington, D.C.

On the other hand, coins are produced by the Department of the Treasury at mint facilities in San Francisco, Denver, Philadelphia, and West Point.

Learn more about how money is made.

Money sign

A currency symbol or currency sign is a graphic that references the amount and type of money.

For example, $50 (fifty dollars) and 50¢ (fifty cents) are two very different amounts. Also, $50 would be fifty dollars while €50 is fifty Euros.

Note: Dollars are used in many different countries. There is the American dollar, New Zealand dollar, Australian dollar, and even pesos use the dollar sign.

The symbol for the dollar is an “s” with a vertical line through it; it can also be drawn with two lines. In usage, the sign is placed to the left of the number.

The cents sign for coins is a lowercase “c” with a vertical line through it. When written, it is placed to the right of the number.

Related: Read about One Dime: Coin Value And History

Functions of Money

Everything considered as money must perform three purposes. The main uses of money are as a:

- Medium of Exchange: Can be exchanged for goods and/or services

- Unit of account: Measures the value of goods and services

- Store of value: Retains its value (purchasing power) over a period of time

A fourth function sometimes used is also a standard of deferred payment. This means that it is an accepted way to repay a debt in the future.

Types of Money

Of all the types, fiat money is the main one used today.

- Fiat Money: Government-declared legal tender that does not have intrinsic value. The value of the money comes from what the government places on it.

- Commodity Money: Money that has an intrinsic value that comes from the commodity it is made out of.

- Representative Money: A commodity-backed money. Something that can be exchanged for a fixed amount of a commodity.

- Fiduciary Money: Money, such as a check, that works on the promise and trust that it will be exchanged for fiat or commodity money by the issuer (bank).

- Commercial Bank Money (demand deposits): A claim against a bank for the purchase of goods and services (through the means of withdrawing in cash, writing a check, or using a debit card).

Properties of Money

All types share these 7 characteristics of money:

- Fungibility: Interchangeable with other units of money.

- Divisibility: Divisible into smaller units.

- Durability: Able to withstand the wear and tear of use.

- Portability: Easily be carried and transported around.

- Cognizability: Its value is easily identified.

- Stability of value: The value should remain constant over a long period.

- Limited Supply: Limited amount in circulation

Importance of Money

It’s not everything in the world, but money plays an important role in our life. It provides the means to afford day-to-day necessities.

We need money in our life to pay for basic needs such as shelter, food, and clothing. However, money can’t buy happiness. Money is not the most important thing in life because it does not bring true happiness, contentment, knowledge, time, friendship, integrity, respect, and peace.

Money Management

The key to living a life with financial wellness is to gain money management skills. It is the process of budgeting, saving, investing, and spending the finances of an individual or group.

Poor financial management is the cause of many people’s stress. The improper handling of personal finances is what leads to debt and a lesser quality of life.

Money management tips that will help you learn how to live on a budget.

- Create a budget

- Pay yourself first

- Separate your money into different bank accounts

- Get your household on the same page

- Lower your expenses

- Live frugally

- Comparison shop

- Don’t try to “Keep up with the Joneses”

- Buy groceries once per month

- Payoff your debt

- Stop using credit cards

- Find cheap ways to have fun

- Try DIY projects to save money

- Save for the things you want

- Keep track of your spending

- Review your progress monthly

- Keep challenging yourself to spend less

Writing out your financial plans is a good way to keep on track with your goals. Use these money management worksheets to create your budget binder.

Financial crimes

Money corrupts people. Unscrupulous people commit crimes to gain more money and fill their bank accounts.

There are many types of frauds and crimes that are used. These are some common types:

- Counterfeit money: Illegal currency created to imitate legal tender.

- Money laundering: A process by which the profits of illegal activities are disguised as being earned from a legitimate business.

- Telephone scam: A scam to steal your money and/ or personal information via phone calls or texts.

- Pyramid schemes: Scams in the form of legitimate multi-level marketing companies. They work by getting a constant flow of new members with the oldest recruiters gaining the most profit.

- Phishing email: A fake email that poses as a legitimate company to get the recipient to reveal personal information, such as usernames, passwords, credit card numbers, or other personal details.

- Heist: Money gained through the robbery of a place.

- Lottery and Sweepstakes Scams: A fraudulent way of gaining money by tricking people into thinking they’ve won a prize. The scammer will ask for a fee to be paid or request personal information to send out the prize.

- Embezzlement: Withholding assets (theft) from the person(s) that entrusted it to you.

- Money wiring scams (money mule scam): A situation in which scammers send you money, then request that you send a portion back o to someone else.

Read this for more common scams and frauds to avoid.