Welcome to finance terms 101! Here, you will learn the finance words that you will need to know along your journey to financial freedom.

Knowledge is power and increasing your financial literacy will help you make educated decisions about your finances. Having more information about the different choices and financial implications of each one will help you make sound decisions.

Glossary of Personal Finance Terms & Definitions

Do you know any of these finance words? Challenge yourself to learn more!

401(k)

A 401(k) is a retirement plan sponsored by an employer. The company may match the contributions made by the employee.

APR

APR, or annual percentage rate, is the yearly interest that is earned on the balance of your credit card or other loans.

Assets

Assets are anything that can provide financial value. They include cash, equipment that can be sold, trademarks, a house, land, etc.

Available Balance

The available balance is the total amount of funds that you have left available to use for purchases in your bank account or on a credit card.

Bankruptcy

Bankruptcy is a legal process filed through the federal court when a business or individual is unable to repay their debts. Though it can help wipe away some of your financial obligations, it can affect your credit for several years.

Compound Interest

Compound interest is a method of calculating interest in which you earn interest on both the initial deposit and the interest earned from it. It can be a good thing when saving but works against you with a loan. Compound interest on a loan adds the money accrued into the principal, thus increasing the owed amount and the interest accrued continuously grows.

Credit

Credit is the ability to get goods or services on the promise that the amount will be paid back at a later date.

Credit Limit

Determined by the issuer, a credit limit is a maximum amount you can spend on your credit card. It takes into account factors such as your credit score, payment history, income, employment status, and other open credit accounts.

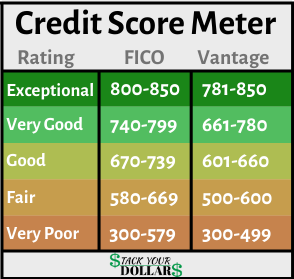

Credit Score

A credit score is a 3 digit number that tells your trustworthiness and reliability in paying back any loans which you may take out. Learn more about credit scores and how to improve them.

Current Balance

The current balance is the total amount of money that is in your account.

Debt

Debt is money owed to others. If you have debt, there are ways to pay down the debt quicker.

Debt Consolidation

Debt consolidation is the act of rolling multiple debts into one loan. It can lower interest payments and/or simplify multiple payments.

Emergency Fund

An emergency fund is money that you stash away for all of those unexpected financial surprises in life. Emergency fund examples include important and unplanned home repairs, car repairs, travel, etc.

FICO Score

A FICO® score is a type of credit score model that has a three-digit number ranging from 300 to 850.

Financial Freedom

Financial freedom means having the financial stability to live life the way you want to without worrying about money. Since everyone wants different things in life, the definition can vary by person.

F.I.R.E

The F.I.R.E. movement stands for Financial Independence, Retire Early. It is a lifestyle of reducing spending and amassing wealth by saving and investing in order to retire and live comfortably by an early age (30s-40s).

Gross Income

Gross income is the total amount of money earned through salary, commissions, bonuses, etc.

Inflation

Inflation is a rise in the price of goods and services which lowers the purchasing power of money.

Liability

Liabilities are financial obligations owed to others such as loans, mortgages, salaries, etc.

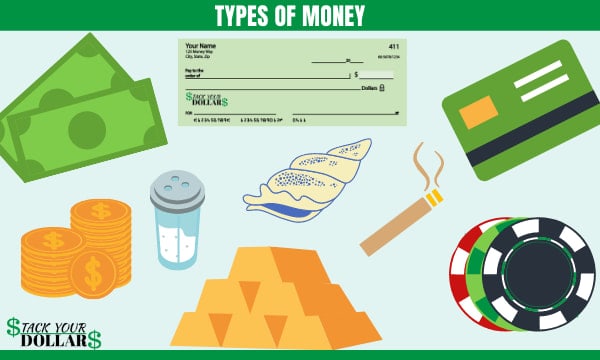

Money

Money is something generally accepted as a medium of exchange for goods and services. There are 5 different types of money: Fiat, commodity, representative, fiduciary, and commercial bank money.

Net Income

One’s net Income is the amount of money left from your gross income after taxes, health insurance costs, etc.

Net Worth

A net worth is calculated from the total amount of assets an individual or company has, minus the liabilities.

Pending Transaction

Pending transactions are bank transactions that have been received but not fully processed yet. A pending deposit may take some time to affect your available balance while withdrawals are more likely to affect it right away.

Roth IRA

A Roth IRA is an individual retirement plan that allows them to set aside a certain amount of after-tax income each year. Contributions can be taken out tax-free after age 59 ½.

Stocks

A stock is a security (financial instrument aka tradable asset) that represents partial ownership of a company.