When looking for a new job, it’s typical to try to figure out if it will be a good salary or wage. So you see one that will pay $60,000 per year? But how much is that an hour? And is that even a livable wage?

Well, I think that’s a great salary to have! Here’s the whole breakdown:

How much is $60000 an hour?

Assuming you work 40 hours every single week of the year (52 weeks), you would be working 2080 hours per year. That would mean a salary of $60,000 a year is $28.85 an hour. That is found by dividing $60,000 by 2080 hours.

Read More: Learn about how your salary might be different based on the varying work hours in a year.

$60,000 per year breaks down to:

- $28.85 per hour (Annual ÷ 2080 hours)

- $230.80 per day (Hourly x 8 hours)

- $1,153.84 per week (Annual ÷ 52 weeks)

- $2,307 biweekly (Weekly x 2)

- $5,000 per month (Annual ÷ 12 months)

However, after taxes, $60000 would be reduced to $21.54 – $23.56 per hour and $44,800 – $49,000 per year depending on the state you live in. Your total take-home paycheck would be:

- Weekly paycheck= $861.53 to $942.30

- Biweekly paycheck= $1,723.07 to $1,884.61

- Monthly paycheck= $3,733.33 to $4,083.33

Whoa! That’s a $350/month difference between the highest and lowest taxed state. Meaning, one person could be paying $4,200 extra per year in taxes. To make the most of your salary, you might want to live in a state that does not tax your income.

States that don’t tax wages: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire, and Tennessee (per Investopedia)

Similar Wages

$29 an hour is how much a year? If you make $29 per hour, your yearly salary would be about $60,320 before taxes. After taxes, that amount would be reduced to $44,900 to $49,300 per year.

$30 an hour is how much a year? If you make $30 per hour, your yearly salary would be about $62,400 before taxes. After taxes, that amount would be reduced to $46,200 to $50,800 per year.

Also, $65000 a year is how much an hour?

$65,000 per year breaks down to:

- $31.25 per hour (Annual ÷ 2080 hours)

- $250 per day (Hourly x 8 hours)

- $1,250 per week (Annual ÷ 52 weeks)

- $2,500 biweekly (Weekly x 2)

- $5,416.66 per month (Annual ÷ 12 months)

However, after taxes, $65000 would be reduced to $47,900 – $52,500 per year depending on the state you live in. Your total take-home paycheck would be:

- Weekly paycheck= $870.90 to $954.54

- Biweekly paycheck= $1,741.81 to $1,909.09

- Monthly paycheck= $3,991.66 to $4,375

Is $60,000 a year a good salary?

$60k per year is a really good salary to live comfortably on. However, everyone’s situation and finances are different.

What counts as a good income depends on where you live, the cost of living in that area, your family size, etc. For my family of 2, we live on half of that amount. I wrote about it here in a post of how we lived on $2,500 per month in California.

Here is also my updated budget of living on $5,000 a month as a couple.

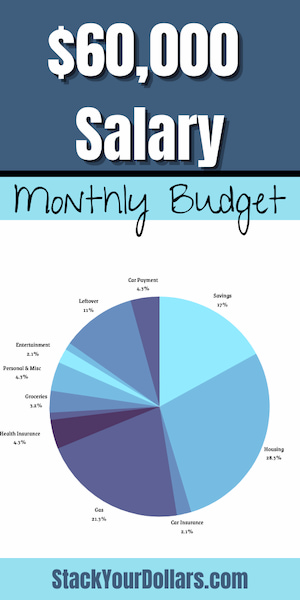

$60000 a year budget

I’ve already said that I consider $60,000 per year is a good salary; however, that may not hold true for everyone’s lifestyle. Here is a list of monthly expenses that you may also need to include.

If I made that amount per year, this is how I would budget my cost of living. I will base it on the lower after-tax monthly paycheck of $3,733.33.

- Savings of 20%= $747

- Rent/ Mortgage + Utilities= $1,244 (⅓ of income)

- Car Payment= $200

- Car Insurance= $100

- Health Insurance= $200

- Cellphone= $50

- Internet= $50

- Gas= $100

- Groceries= $150

- Personal & Misc.= $200

- Entertainment= $100

- Total = $3141 with $592 leftover

This salary would give a lot of people extra money to play around with. However, you could also possibly live well on half of that amount and save or invest the rest.

How to Live on $60,000 a Year

Regardless of income, the most important thing is to live below your means. The main reason why people end up in debt is because they are spending more than they earn; that is not good if you want to live a life of financial freedom.

The 4 main steps to being financially secure with your income are to:

- Create a budget: Learn how to create a simple budget here.

- Save money: Remember, save first then spend.

- Lower your expenses: Here are 40 frugal living tips that I live by.

- Pay off debt fast: Paying the minimum results in crazy interest fees. Fast track your debt payoff by doing these things.

Learn more tips with my guide: How To Live On A Budget.

How can I earn $60,000 per year?

Hello Nicholas, to earn $60,000 per year, look for the different jobs that pay this amount. There are many skilled trades that would only require a certificate (or possible on-the-job training) in order to get into the field, such as an HVAC technician or welder. Truck driving is another career field pays very well.

@Nicholas Rivera,

I don’t know where you stand now, but it’s certainly possible in most cities.

I met someone recently that never graduated HS making close to 6 figures in HVAC . ( Not a starting salary)

Warren Buffett says ‘The best investment you can make is in yourself. ‘. If you learn skills and abilities that are in demand, someone will pay you if you are willing to work.

On what planet are you living that $60k a year is upper middle class?? In Nicaragua, maybe? Not in the United States. Home prices are averaging around $250k and those “upper middle class” homes start at $550k easily. I don’t know this website but I would definitely take what they say with some serious independent thinking.

Opps!😣 Thank you for catching that error. I’m not sure what I was thinking about at the time I wrote it!

I make 60,000 / year and its not that great anymore especially in 2021. My bills are generally 2-3x all your estimates today and it barely covers cost without any savings. You have to make 150k it seems or more if you want any kind of retirement. It is never going to happen on 60k… 3BR house, utilities alone is about 2300$ /mo in Texas. This article is wildly inaccurate. But it does show some useful advice.

Hi Ken! 👋 Living on 60k per year truly depends on your family size, location, and personal choices. In my area, I rented a 3br house with a garage in a nice area for $1,300/mo (buying a home is even cheaper).

My family only consists of 2 adults and a pet, but the totality of our expenses are under 30k per year. There are many creative ways in my other posts to cut back and reduce bills.

Your monthly budget made no reference to utilities-(ie: natural gas, electric, etc.) Also, with gas at over $3.00 per gallon, unless you are allowed the privilege to work from home, it costs well over $100 a month for gas for my used automobile, the payment on which is over $200. Groceries are well over $150 a month at today’s prices and I don’t eat meat, but once you consider laundry detergent, toiletries, dog food, even on my vegetarian diet, I spend more than that. While 60K is an “okay” salary, I find that saving even 300 a month is nearly impossible and I am one of the most frugal people around.

Hi Heather! This was supposed to be a quick example of a possible budget, which is why I didn’t go into too much detail for utilities. I lumped it all into one section “Rent/Mortgage + Utilities”.

As I like to reiterate in all of my posts, everyone’s situation is different. However, what I share is not pulled out of thin air. It’s a possibility (based on the way that I live) that some people can aim to achieve. You can also view my actual $2,500/mo budget for two from when I lived in California along with my $200 grocery budget for 2. However, on a single income, my family definitely does make under $60k per year and we are able to save over $300/month.

Hi Martina,

I just wanted to thank you for laying this all out. I was trying to figure out how 60k breaks down per week/biweekly/monthly and you made it super simple for me! Sorry there are such negative Nancies out there… I think you’re offering a lovely service. Keep up the good work! ( :

Hi Susie. I appreciate your kind words. Thank you for the support!

Martina, we live in the Central Coast area of California. We moved here about 7 years ago from LA. I appreciate your efforts to lay all this information out. It’s helpful and useful. For the past several years, my salary has been exactly $60,000. Luckily, I get to work from home, driving once a month to LA for a day or two, which is reimbursed by my company. We’re able to save money every month, despite a mortgage and property taxes. We are disciplined but not fanatical about our spending and lifestyle, and we’re happy with our freedom and flexibility.

You’re correct to point out that each individual case is different. You’re also correct to say that living a good life is possible here in California. Some folks’ circumstances make that difficult or impossible to achieve, but we feel blessed to be here. We donate regularly to nonprofit groups that stand ready to help those needing shelter, food, and care—even to agencies that help people get control of their finances. We believe that blessings need to be shared, and, even at $60,000 a year, our circumstances make that possible.

Keep up the good work!

Try $90 a week in gas at $360 a month or $4320 a year. FURTHERMORE, the US government over taxes us to the point where $80k is more of a median. The price of everything is way too high!

I agree! The cost of everything is rising a lot.

As someone who’s saved 50-75% of their pay at times, I would agree that some of these numbers are fairly unrealistic. Most notably $150 for groceries. $5 per day? That would be tough even as an extreme shopper and that’s an unproductive activity.

Car payment of $200 is never going to happen for most people, however it is possible to keep avg auto exp in thàt range by purchasing an older car with low miles. (I always pay cash )

Overall this is a good article. While some readers will use these extreme disparities as a reason to dismiss the author, that says more about the reader than the author. (Self-selection biasis cause us to seek out information that confirm what we already believe. So someone that spends $100 per month on their cell phone bill will see that as ‘the only way’ because who can survive with a cell phone that doesn’t have the highest data plan? Surely it isn’t possible to get talk in most major cities for just $5-10 per month? Or even ‘unlimited data for $25 per month? Tello / visible.)

You based your budget off the 65K not the 60K

Wow, at least you know it’s a human writing these posts! Lol. Thank you for catching that, it has been corrected.

-Martina

Very helpful & easy to understand! Thank you!