In his stimulus plan, President Biden proposed that the federal minimum wage be raised from $7.25 an hour to $15/hour. But what does this mean for our wallets? $15 an hour is how much per year?

As you can see so far, it’s more than double the current wage!

15 Dollars an hour is how much a year?

Someone making $15 an hour would make about $31,200 per year for working full-time (40 hours). To calculate your yearly salary, you would multiply the hourly wage by 2080 hours.

$15 an hour breaks down to:

- $120 per day ($15 x 8-hour workday)

- $600 per week ($15 x 40-hour week)

- $1,200 biweekly (Weekly x 2)

- $2,600 per month (Annual ÷ 12 months)

- $31,200 per year ($15 x 2080 hours)

However, after taxes, $15 per hour would be reduced to around $11.88 to $12.84 (depending on the state you live in). That means that your annual salary would be $24,700 – $26,700 per year after taxes. Your total take-home paycheck could be:

- Hourly pay= $11.88 to $12.84

- Daily paycheck= $95.04 to $102.72

- Weekly paycheck= $475.20 to $513.60

- Biweekly paycheck= $950.40 to $1027.20

- Monthly paycheck= $2,058 to $2,225

Ouch! That’s a drop of $4,500 to $6,500 between the highest and lowest taxed state. To make the most of your salary, you might want to live in a state that does not tax your income.

States that don’t tax wages: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire, and Tennessee.

However, it is also beneficial to compare the cost of living in different states. Your money can go further in some.

15 Dollars an Hour Jobs

These are jobs paying an hourly wage of at least $15.

- Target employees

- Customer Service Representative

- Teachers

- Warehouse Workers

- Recreation Programs Specialist

- Leasing Agent

- Library Specialist

(I found these positions by searching job boards for my area.)

Is $15 an hour good?

$15 per hour is certainly much better than the current federal minimum wage, however it still isn’t a great salary. $7.25 per hour is $15,080 per year, so $31,200 is quite an increase, but you would still need to budget and spend money wisely in order to get by.

My family of two has successfully done this living on $2500 a month. That would be about $17 an hour after taxes, but we certainly still have a lot of wiggle room. By not having a car payment, that budget would drop a little over $250/mo.

I think that $15 an hour is a livable wage for a small family, but it can be hard for larger families unless there is another source of income. It will also largely depend on where you live and how you budget.

How to Live on $15 an Hour

No matter how much money you make, the most important thing is to live below your means. The main reason why people end up in debt, even rich people, is because they are spending more than they earn. If you want to live a life of financial freedom, that is not good.

The 4 main steps to being financially secure with your income are to:

- Create a budget: Learn how to create a simple budget here.

- Save money: Remember, make saving a priority before spending.

- Lower your expenses: Here are 40 cheap living tips that I live by.

- Pay off debt fast: Paying the minimum fee results in crazy interest amounts. Fast track your debt payoff by doing these things.

Learn more tips with my guide: How To Live On A Budget.

For example, you can save money on housing by:

- Renting a room

- Living in a smaller home

- Living outside of the city (cheaper homes but longer commutes).

I also have a post on my monthly grocery shopping list where I only spend $200 (meal plans included)!

$15 is a good hourly wage, but if you can’t make this salary work for your lifestyle, then it might be best to look for a better paying job or pick up a side hustle.

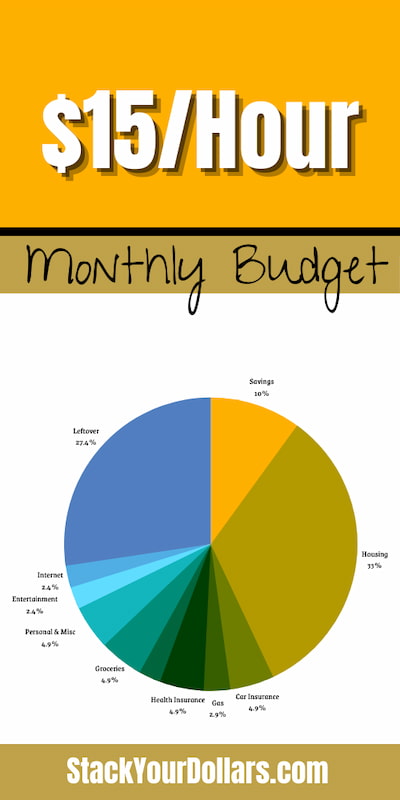

$15 an hour budget example

Not sure how to budget and live off $15 an hour?? Maybe this will help.

This budget breakdown will be based on the lower of the two after-tax monthly salaries: $2,058. Of course, the expenditures in your life may be completely different.

Play around with the numbers and find what will work for you while still allowing you to save money and live a good life.

- Savings of 10% = $205.80

- Rent/ Mortgage + Utilities= $679 (⅓ of income)

- Car Payment= $0 (You can purchase a cheap Honda or Toyota for about 2k.)

- Car Insurance= $100

- Health Insurance= $100

- Cellphone= $50

- Internet= $50

- Gas= $60

- Groceries= $100

- Personal & Misc= $100

- Entertainment= $50

- Total = $1494.80 with $563.20 leftover

It may not be easy to budget on this salary, but it is doable. The key is to prioritize your needs and not waste money.

Nice interesting. But, i live in Indonesia can not do that.

I’m sorry I don’t know of your country to suggest any resources! However, you maybe be able to reach this wage or more by doing freelance work online with any skills you have.

Really, Really glad to have found this informational breakdown. I could’nt figure out why my hourly rate was just not adding up. Thanks!

My pleasure! 🙂

This is not correct I’m sure the other points that this person has made is somewhat correct but you do not make 31k from 15 an hour it’s more like 28k 800 before taxes and like 20k 640 after they messed up the math when they did it monthly its supposed to be 2400 not 2600

Hi Takoma, it’s a bit more complicated than that. In reality, the monthly salary can be $2,400 to $2,600 depending on the number of weeks in that month (since in ranges from 4-5). To make it less complicated, I only took the annual salary and divided it equally into the 12 months of the year.

2080 work hours is also the amount that most HR departments use to estimate yearly wages. Therefore, 2080 x $15 is $31,200.

If you’d like to make things even more complicated, there are ACTUALLY 2080 to 2096 work hours in a year, so $15 an hour can range from $31,200 to $31,440 before taxes.

@Martina, working 8 hours for 5 days a week is 600 a week and 2400 a month and taking that by 12 months is 28k 800 you need to stop multiplying it by 52 weeks because on average people only work 260 days because they are only working 5 days not 7 another example would be if someone took 25 dollars a week and put it in their savings for a year they would end up with 1200 by the end of the year but if you do it like how you said then you would end up with 1300 which is not correct and the higher amount of money you try doing the math when multiplying by 52 weeks the more wrong it’s going to be it’s really not that hard

Hi Takoma,

For the yearly salary, $15 is actually multiplied by the 2080 work hours that Human Resources approximates people work in a year (though the actual time varies). 2080 hours is also equal to 260 8-hour workdays.

The monthly salary is also only an approximation since every month has a different amount of days. $2400 per month (28,800/yr) would only be the monthly salary if they work exactly 20 days every month, which isn’t right either. That is why I chose to use the yearly amount and divide it evenly into 12 months.

@Martina, you arent using the yearly amount and dividing into 12 months when you are adding 2 additional days that people are not working, like I said they most work 5 days a week which averages in a year to being about 260 days, not really sure why you are trying to tell me about the only working the average 260 days a year when I’m the one who brought it up to you in the first place and you are trying to act so sophisticated with it when it’s pretty simple. I have calculated multiple different times what I make a year after taxes and from what I calculate my total salary to be until when I got up to do income taxes and they tell made what I had made yearly before and after taxes it’s almost spot on to where I’ve calculated it to be, at most I’m like 1200 off but I also work different amount of hours everyday so it makes sense for me to be a tad off whereas for someone who has the same start time to the same finish time everyday for the entire year would be more on point with calculating their yearly income. I’m sorry but as I said before you pretty much wasted your time with this site with false information and while it does suck that you tried your very best with all of these calculations that you did but you ended up confusing yourself in the process and now anyone who would come across this not knowing how it works will be on the same boat as you so it would probably be best that you just delete this site and spare people in the future of the false information

Hi Takoma,

I believe this will be my last reply in regards to this subject. I just noticed that you have been returning to my page to comment your disagreement since August and I’m not sure of your purpose in this.

First, I was agreeing with you that people work (on average) 260 days per year.

260 days per year x 8 hours per day = 2080 hours per year

2080 hours per year x $15 per hour = $31,200 per year

Second, I also agree that my math is not completely accurate. However, that is due to the varying work days every year (260-262).

I also can’t know everyone’s tax situation to say their exact after-tax income.

If you do not agree with the information I share, there are various other sites in which you can find your answers as well.

Have a great day,

-Martina

@Martina, the only thing I’d agree with you on is the 2080 working hours a year because that makes sense taking your weekly 40 hours and multiplying it by the 52 weeks but it doesnt work like that all around which is where you are getting mixed up at because if we were to take my weekly paycheck or let’s just say 100 dollars a week and multiply it by 52 then you get 5k 200 which is incorrect because 100 dollars a week a year is in fact only 4k 800 a year which is where you would do the math differently and multiply by 4 and then 12 instead of 52

Whoever wrote this has either never lived on their own, or they’re contacting the internet from 1980– maybe earlier! Hello person with shoulder pads, huge bangs, and most likely a cocaine habit. You’d have to be free-basing to think this budget example would assist anyone in 2020. On what PLANET does health insurance go for $100? ALL of your utilities are coming in under $700 dollars?!

This helpful “budget example” of yours is a tiny pile of misleading bullshit. I was REALLY digging this article as an ex-bartender, now warehouse associate. I’m currently changing it up and switching to an hourly job. One that I know will obviously pay WAY less at the end of the week than my previous employment. I was interested to hear how one can budget on $15 an hour and be okay! Well, person wearing bangles and leg-warmers, you’ve officially frightened all of us $15.00 an hour employees from 2020! Who paid you to write this ridiculous fiction in budget form? Maybe you’re not from 1980…. Maybe you’re from your mother’s basement. Can’t tell.

Thanks for nothing!

~E

Hello, E. As I’ve said repeatedly, budgets and prices vary by people and locations (this is just an example). And yes, my utilities in a 3 bed/2 bath house are $200 – $300 per month. If you’d like to learn ways to lower your monthly expenses, please take a look at my other post: How to Live Cheap.

-Martina